The AP on the Street Yearly Recap ’22

The AP on the Street Yearly Recap ’22

What a year it was… 2022 was definitely a milestone for every investor and policymaker.

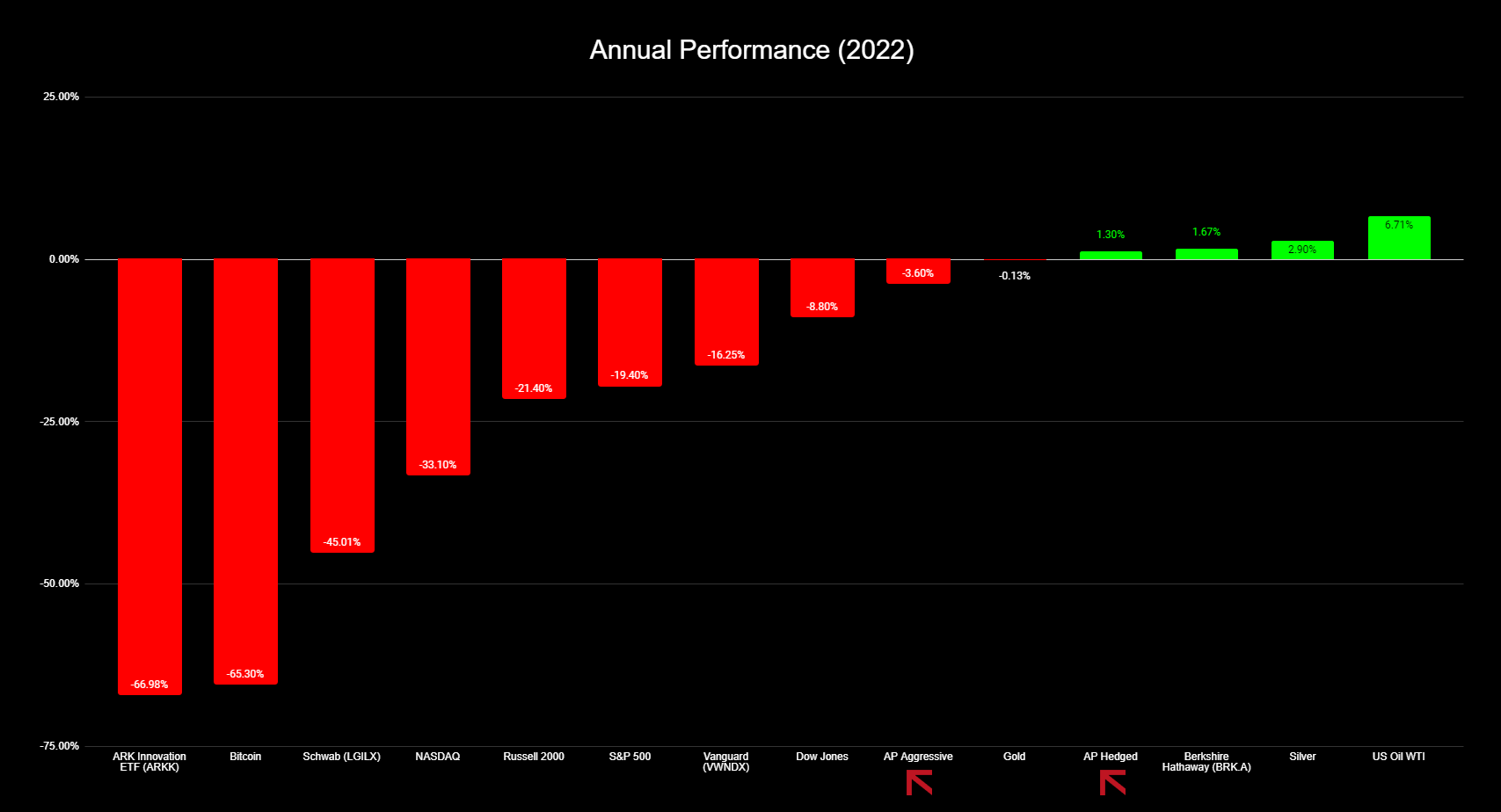

The past year was an eventful one all over the world. From volatile swings in the stock market to FED decisions, the US financial markets experienced a wide range of developments. In this article, we will provide a comprehensive annual recap of what happened in 2022. Then, we will discuss the most profitable instruments/ portfolios out there during 2022.

So, let’s look at what happened in 2022 and compare the performances of various instruments/ portfolios:

January

January was marked by market volatility, with the S&P 500 recording its worst month since 2020.

Microsoft proposed the acquisition of Activision Blizzard (ATVI), while Warren Buffett’s Berkshire Hathaway revealed itself as a buyer of ATVI shares. However, it was blocked by the Federal Trade Commission.

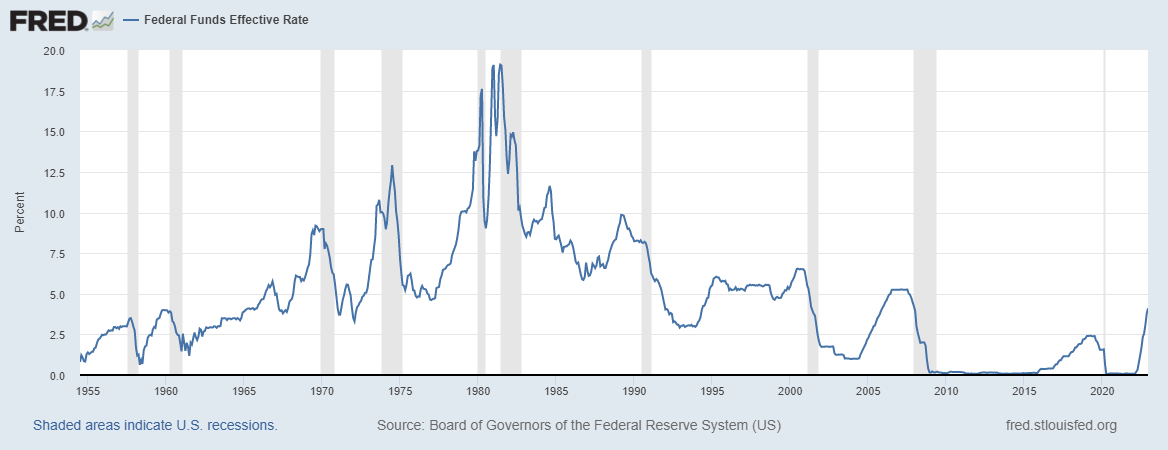

By the end of the month, the Fed was signaling that it would start to raise rates at its March meeting.

February

In February, stocks significantly declined due to increasing inflation and rate hike expectations. The S&P 500, Dow Jones Industrial Average, and NASDAQ all fell by at least 3%, and the Nasdaq was down 12% on the year.

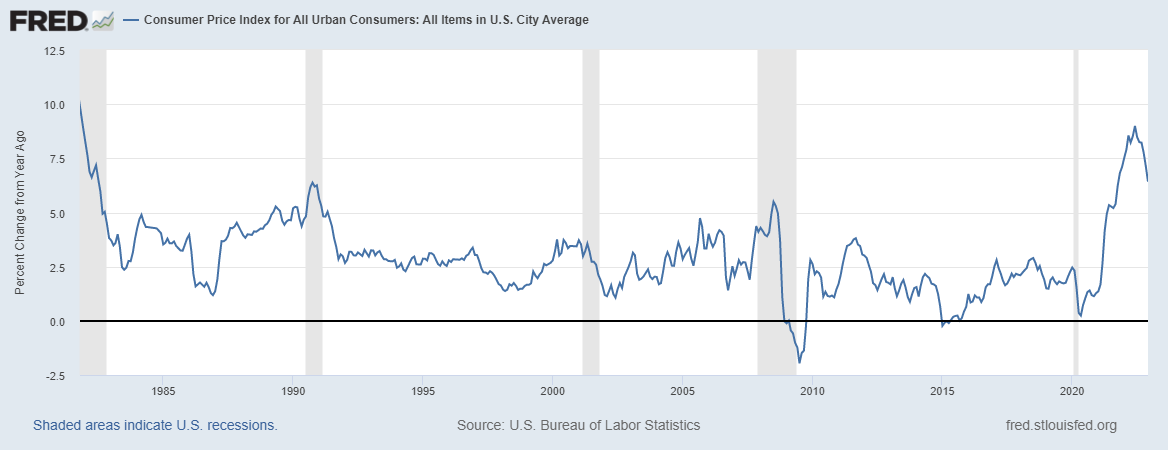

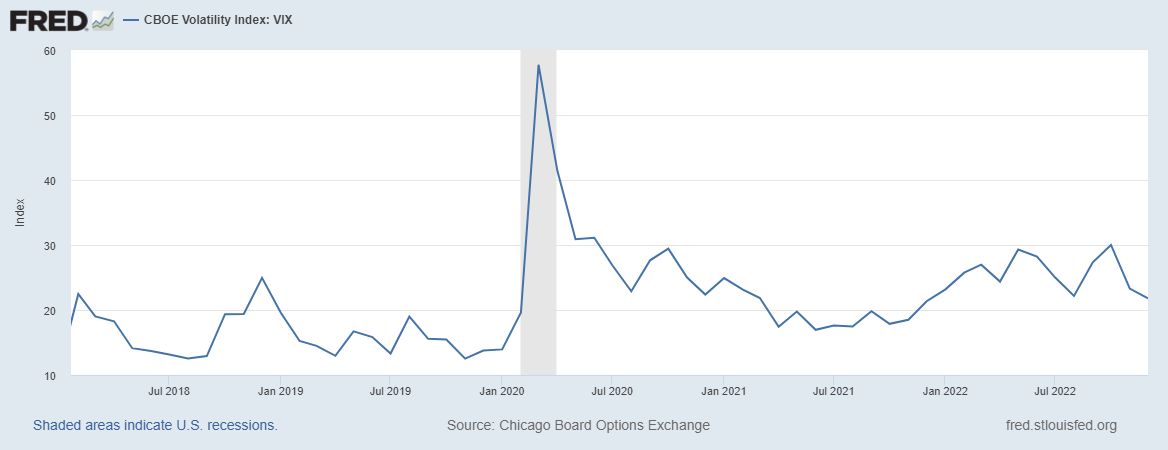

CPI Inflation was the main topic, with headline annualized CPI inflation in January being the highest since 1982. The war in Ukraine has had a significant impact on the global energy and food markets, causing major price increases in oil and gas, as well as other commodities such as grain. This has also caused a rise in inflation and increased volatility in the stock market. The VIX Volatility Index rose to 25.75 points.

March

In March, stocks reversed their downward trend, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posting gains. However, the quarter ended with all three major averages down more than 4%.

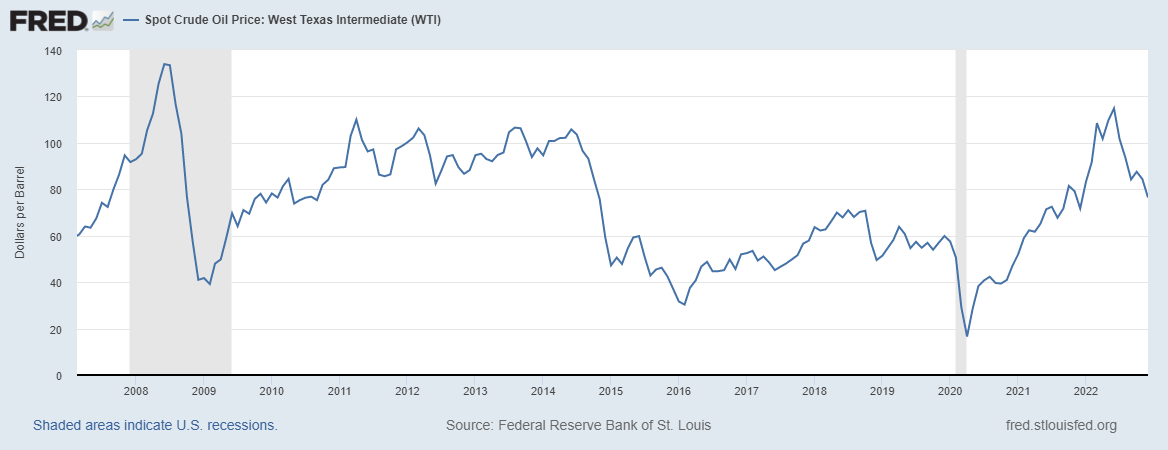

The Biden administration proposed a plan to release a million barrels of oil from the Strategic Petroleum Reserve, the most significant release in US history, in an effort to lower gas prices. The White House also imposed a ban on imports of Russian oil and liquefied natural gas.

April

In April, US equity markets were sharply sold off as investors focused on the inflation rate and the Federal Reserve’s policy response. Annual inflation reached 8.5%, its highest since December 1981, prompting the Fed to suggest a 50-basis-point increase in May. Technology stocks took the brunt of the hit, with the Nasdaq suffering the most.

Billionaire Elon Musk brought attention to the market by agreeing to buy social media giant Twitter for a total of $44 billion.

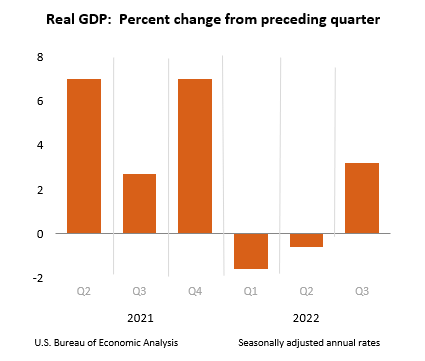

Yields on Treasury notes rose in expectations of rising interest rates, with the 20-year rate hitting 3% for the first time since 2019. At the same time, US data showed a GDP contraction in the first quarter.

Crude oil prices dropped after the IEA agreed to release emergency reserves, while Gazprom’s halt of shipments to Poland and Bulgaria was met with strong criticism from the EU. Meanwhile, Emmanuel Macron was reelected as President of France.

May

In May, the stock market dropped significantly but then ended almost flat.

The Federal Reserve raised interest rates by 0.5%, the most since 2000, and signaled more hikes were to come.

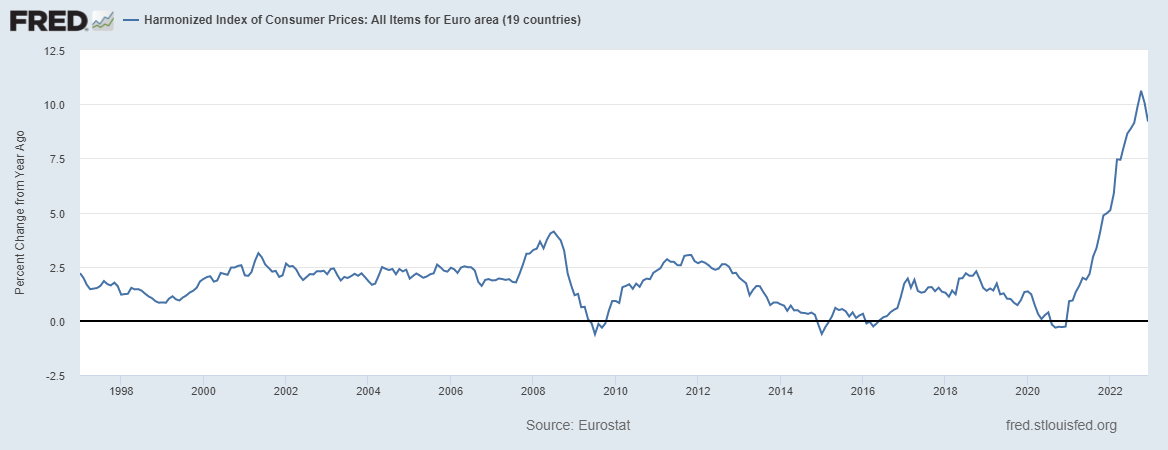

Bond yields rose in Europe after the EU CPI inflation rate reached 8.1%; meanwhile, oil prices rose due to the European Union proposing a ban on Russian crude imports.

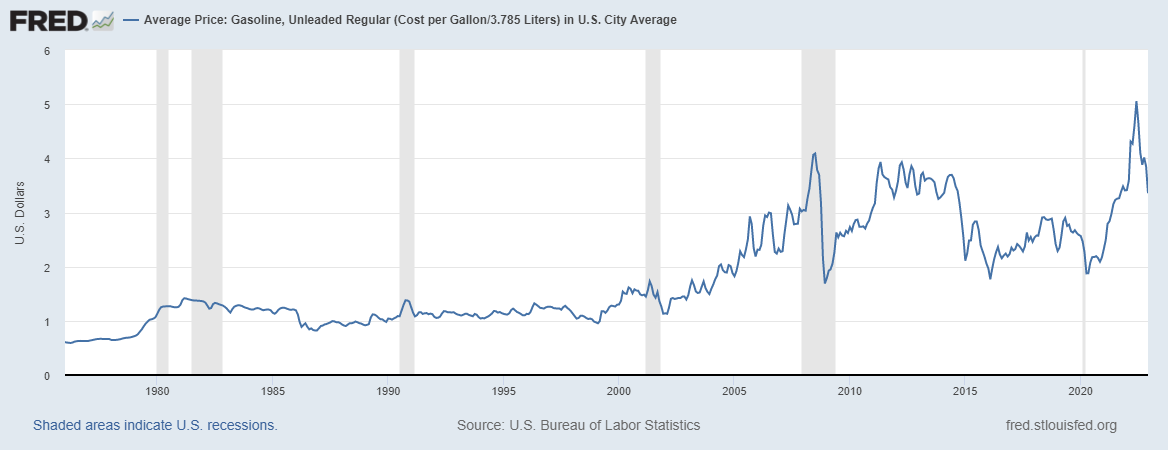

Additionally, the US saw gasoline prices reach a record high. Sweden and Finland applied to join NATO but were blocked by Turkey. Lastly, Russia took the city of Mariupol following intense fighting.

June

During June, central banks around the world took action to address an acceleration in inflation by raising interest rates. The US CPI saw its highest level since November 1981, with a whopping 9.1%.

The Bank of England increased interest rates by 25 basis points, the Swiss National Bank increased rates for the first time in 15 years, and the ECB said that it would raise interest rates in July after ending its quantitative stimulus program.

This trend includes the Federal Reserve making its largest increase in 28 years, with other countries such as Canada, Australia, Norway, and Sweden also increasing their rates. Meanwhile, the Bank of Japan decided to keep its policy unchanged, resulting in the devaluation of the yen.

Global sovereign bond yields rose due to the inflation threat, while equity markets decreased, pushing the S&P 500 further into bear-market territory. Additionally, European gas prices surged after Russia’s Gazprom reduced its gas supply to Germany. Lastly, the EU granted Ukraine official candidate status.

July

In July, the US economy entered a recession, by definition, after the GDP dropped by 0.9%.

Central banks worldwide took action to try and repress inflation, with the Federal Reserve hiking interest rates by 75 basis points for two months straight.

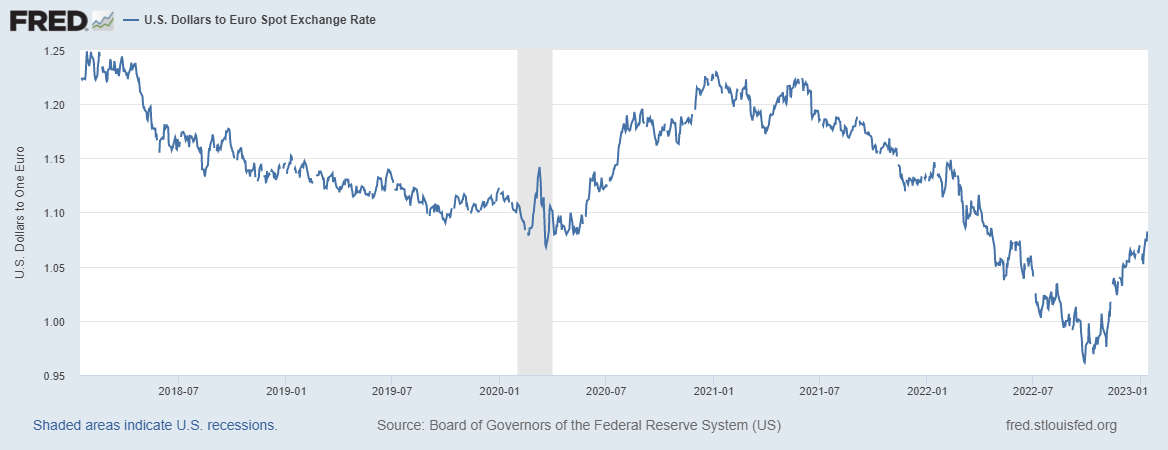

Anyway, the ECB chose to end its negative interest rate policy in response to the energy crisis in Germany. Currencies were impacted too. The Euro dropped below parity compared to the US dollar due to the relatively doveish ECB policy and recession fears in the Eurozone.

Additionally, Italian Prime Minister Mario Draghi resigned, leading to a decline in Italy’s bond and stock markets. Also, Boris Johnson resigned as prime minister in the UK over an ethics scandal.

Companies reported second-quarter results, with many not able to reach the high earnings growth of the summer of 2021.

Cryptocurrency market investors panicked and withdrew, making Bitcoin fall below $22,000. However, it eventually managed to rally back up on assumptions that Federal Reserve would ease up on its rising rate.

US, Europe, and Japanese stocks all finished the month higher. In contrast, China maintained its COVID-19 restrictions, which damaged its economy.

August

In August, investors initially expressed optimism the Fed could slow rate increases.

However, concerns about the Chinese lockdowns’ impact on global supply chains and earnings forecasts caused stocks to dip.

Strawberry on top was; Federal Reserve Chairman Powell further indicated rising rates would cause economic hardship in his speech during Jackson Hole.

Major tech stocks like Tesla, Microsoft, Amazon, and Alphabet all decreased by more than 6%.

Chinese tech stocks increased due to a US-China agreement allowing American regulators access to Chinese company audits.

Energy prices climbed in Europe due to the Ukraine war and later retreated when the EU proposed emergency measures to decouple electricity and gas.

Inflation in the Eurozone rose to 9.1%. The ECB indicated a larger increase in interest rates in September was needed to contain inflation, despite its potential negative economic consequences.

September

In September, the US Federal Reserve (Fed) and the European Central Bank (ECB) increased borrowing costs by 75 basis points, while inflationary pressures across the Eurozone remained high.

Amidst this environment, bond yields rose to levels not seen since the early 2010s, while Italy held parliamentary elections, which saw a right-wing bloc led by Giorgia Meloni gain a majority.

The G7 Group of Seven countries also agreed to place a price cap on Russian oil from early December. All of these events made for a volatile month on Wall Street, resulting in the worst performance since the early days of the pandemic.

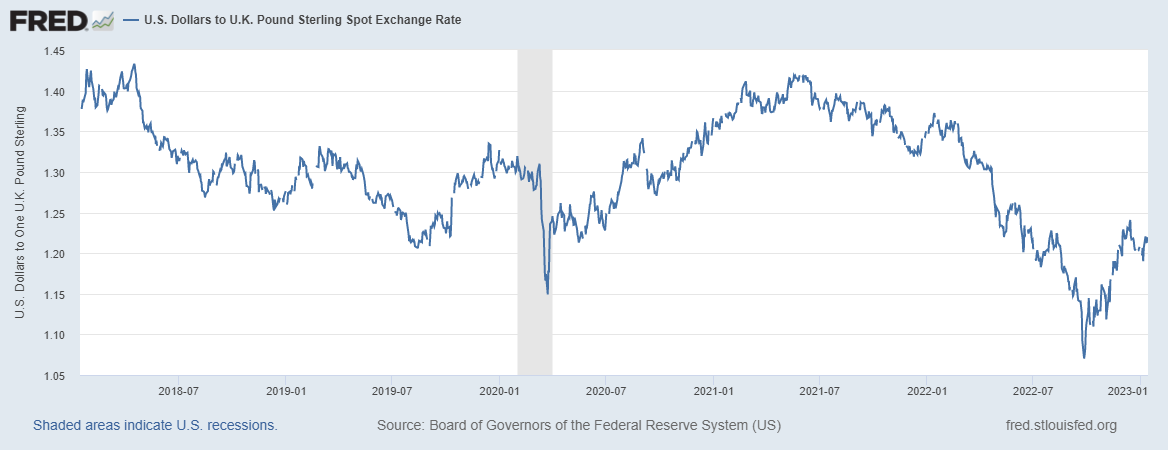

Liz Truss was appointed as the UK’s new prime minister outside the Eurozone following a Conservative Party leadership contest. Her government’s “mini-budget” announcement, featuring energy subsidies and tax cuts without funding, caused UK sovereign bonds to drop and the exchange rate of sterling to reach its lowest point against the US dollar since 1985.

This sudden decrease in the currency market led to the Bank of England intervening to safeguard pension funds and the more extensive financial system. The rough start to Truss’s brief tenure as prime minister began at the same time as the sad passing of Queen Elizabeth II.

October

In October, stock market investors experienced an unexpected rebound in the fourth quarter due to a few members of the Federal Reserve opening on the risk of over-tightening.

This narrative of a Fed pause or pivot was further supported by the decline of Treasury yields, allowing stocks to find a firmer base.

Additionally, investors were concerned about corporate America’s performance in the third quarter as pressure from inflation, a higher dollar, and rate hikes could squeeze margins.

Despite this, a blowout quarterly report from Apple reinvigorated investor sentiment in big tech.

November

In November, stocks gained favor among investors, resulting in two consecutive monthly rises for the first time since 2021.

However, this optimism was dampened by the Federal Reserve’s massive rate hike and Powell’s warning that it was too soon to think of a pause. When the US midterm elections came around, the ‘big red wave’ of Republican victory did not really materialize, with the Democrats retaining control of the Senate.

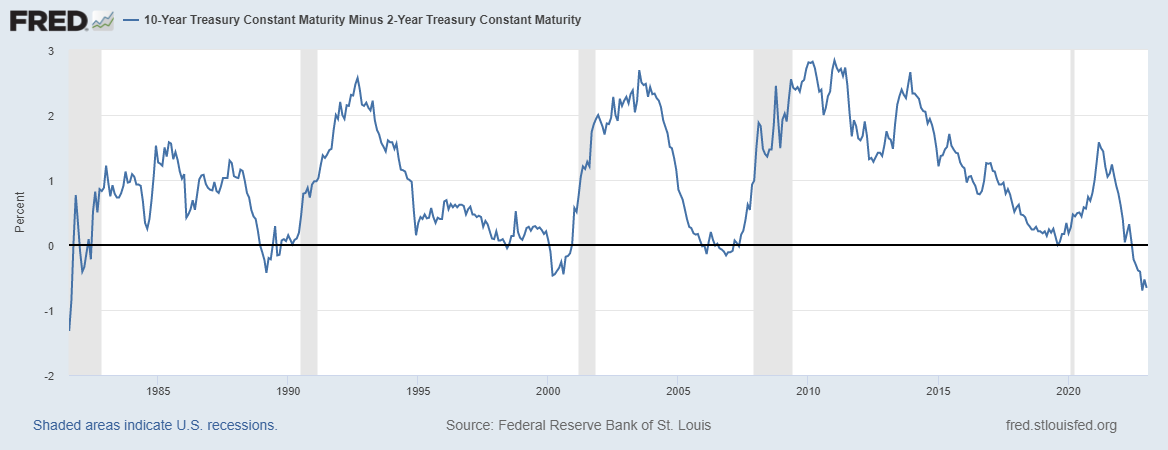

Wall Street welcomed this political gridlock, and with inflation cooling, there was the expectation that the Fed would soon pivot, causing Treasury yields to drop. The yield curve had its biggest inversion in 40 years, suggesting an incoming recession.

On the last day of November, Powell gave a speech that signaled interest rates would remain high for some time, although that didn’t stop investors from predicting a rate cut for the second half of 2023. This caused a surge in stocks and other risk assets.

In contrast, crypto markets reacted with panic. Specifically, FTX, one of the biggest crypto exchanges, was met with questions regarding its solvency. Its CEO, SBF, attempted to reassure users, but Binance took the initiative and sold its holdings of FTX’s token FTT.

This caused a greater demand to withdraw funds from the platform, leading FTX to try and secure emergency funding, which was ultimately unsuccessful, resulting in bankruptcy. Subsequent investigations revealed details that further shook investor sentiment on cryptocurrencies.

December

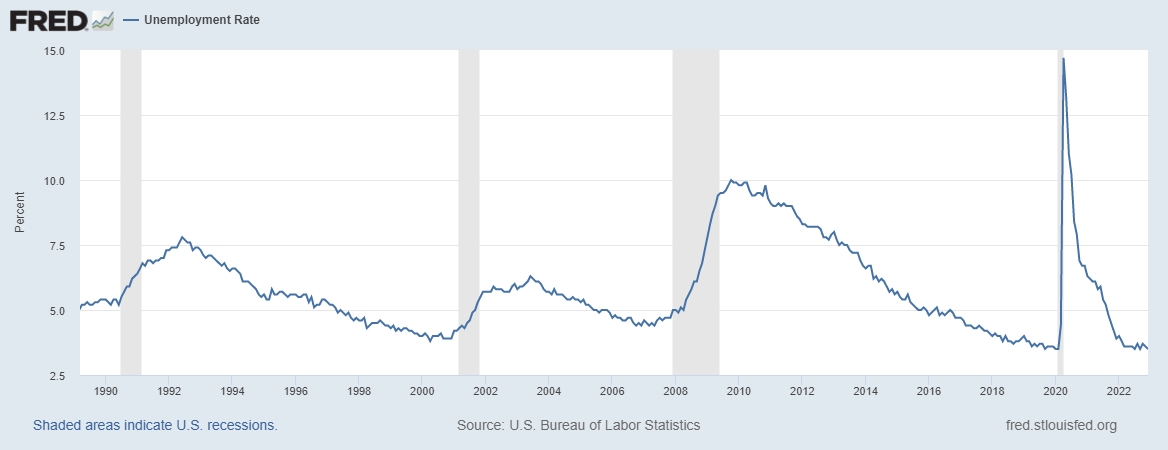

In December, a booming jobs report demonstrated the solidity of the economy, yet the bond market sounded the alarm concerning the likelihood of an impending recession.

The yield curve saw its most significant inversion in 40 years, suggesting an incoming recession on the horizon.

The Federal Reserve responded by forecasting higher-than-expected rates, challenging the market’s expectations of a rate cut in the near future. Following the announcement, risk assets decreased in popularity, and Treasury yields started to rebound. As the year comes to an end, investors remain hopeful that the Federal Reserve will reverse its policy if the economy takes a dive.

We wish all of our followers and users an amazing year. Hopefully, 2023 would be less insane compared to the last year. Take care!

Graph sources:

[1] https://fred.stlouisfed.org/series/CPIAUCSL# | Percent Change from a year ago + between 1981-2022

[2] https://fred.stlouisfed.org/series/VIXCLS# |Between 2018-2022

[3] https://fred.stlouisfed.org/series/WTISPLC#0 |Between 2007-2022

[4] https://fred.stlouisfed.org/series/T10Y2Y# | Between 1981-2023

[5] https://fred.stlouisfed.org/series/APU000074714#

[6] https://fred.stlouisfed.org/series/FEDFUNDS#

[7] https://fred.stlouisfed.org/series/DEXUSEU

[8] https://fred.stlouisfed.org/series/CP0000EZ19M086NEST#

[9] https://fred.stlouisfed.org/series/DEXUSUK

[11] https://fred.stlouisfed.org/series/UNRATE# | Between 1989-2022

[12] MSN Money, Yahoo Finance