The AP on the Street 9th Week of 2023

The AP on the Street 9th Week of 2023

The last week was better than the week before; we had positive numbers on both stocks and commodities.

This week, there are the Unemployment rate, JOLTs, and FED Chairman Powell’s testimony. So, let’s take a look at what happened last week:

- JP Morgan analysts warned that the S&P 500 is overvalued; the risk-reward level is currently unappealing.

- US Treasury Secretary Janet Yellen said the inflation battle is so far, so good.

- Elon Musk became the richest person again.

- France’s CPI rose 6.2% year-on-year —10 basis points higher than expected.

- Spain’s CPI rose 6.1% year-on-year —20 basis points higher than expected.

- Chevron raised the stock buyback target rate to $17.5 billion.

- US10YR has risen to 3.95% —the highest level since November 2022.

- Germany’s CPI rose 8.7% year-on-year —20 basis points higher than expected.

- US ISM Manufacturing PMI came out as 47.7 —0.3 points lower than expected.

- US2YR has risen to 4.86% —the highest level since June 2007.

- President of the Minneapolis FED Neel Kashkari wanted higher rates after concerning inflation data.

- US had the biggest inversion between US2YR and US10YR since 1983, 90 basis point difference.

- Euro Zone CPI rose 8.5% year-on-year —30 basis points higher than expected.

- Euro Zone Core CPI rose 5.6% year-on-year —30 basis points higher than expected, an all-time high level.

- Tesla stock plunged after the “Investor Day” fell short on details.

- Japan 10YR rose above the BoJ’s rate ceiling.

- US ISM Non-Manufacturing PMI came out as 55.1 —0.6 points better than expected.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 1.0%

S&P 500 = 1.0%

NASDAQ = 1.5%

RUSSELL 2000 = 1.3%

Gold = 2.3%

Silver = 3.1%

Oil = 5.1%

The weekly performance of S&P 500 Stocks

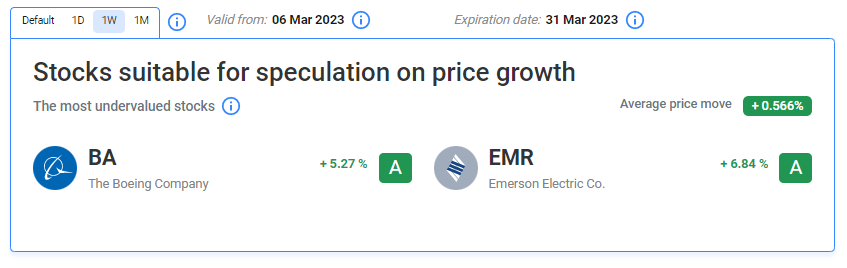

Let’s look at the most undervalued stocks listed on our website:

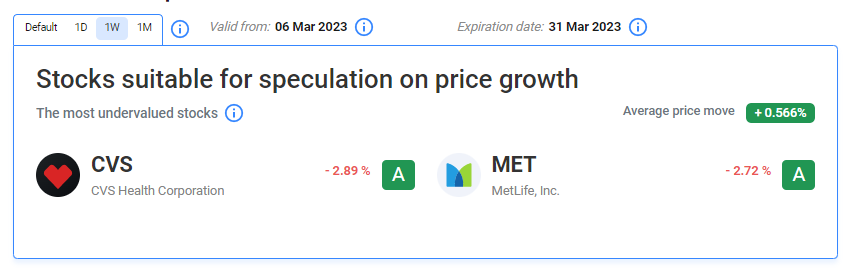

Our Two Least Performing Stocks:

The main reason(s) for the decline in CVS: US Congress started an investigation about Middlemen’s effect on drug prices.

The main reason(s) for the decline in MET: MetLife Investment Management bought several stocks and even initiated an acquisition.

TIL: What is the fat finger error?

A fat finger error is a human mistake that happens when someone inputs wrong information on a keyboard or mouse. It can cause problems in financial markets like buying or selling too much or too little of something.

Important data/ decisions that will be published next week:

The Unemployment rate, JOLTs, and FED Chairman Powell’s testimony

We believe this week will be a crucial week due to Chairman Powell’s testimony. We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.