The AP on the Street 7th week of 2023

The AP on the Street 7th week of 2023

The last week was quite negative for the investors, especially considering the FOMC members’ speeches.

This week, there are the PCE Price Index and the Core PCE Price Index. So, let’s take a look at what happened last week:

- Adani Enterprises went down even more.

- The US sold 26 million more barrels from the strategic reserve.

- Japan’s GDP rose 0.6% year-on-year, officially entering a stagnation period. —140 basis points lower than expected.

- Euro Zone GDP rose 1.9% year-on-year, as expected.

- US CPI rose 6.4% year-on-year —20 basis points higher than expected.

- US Core CPI rose 5.6% year-on-year —10 basis points higher than expected.

- Palantir shares skyrocketed after their first profitable year.

- Airbnb shares soared after their first profitable year.

- UK CPI rose 10.1% year-on-year —20 basis points lower than expected.

- UK Core CPI rose 5.8% year-on-year —40 basis points lower than expected.

- Turkey’s stock market, BIST, jumped after re-opening.

- Berkshire Hathaway added Apple shares to their portfolio and sold TSMC shares in Q4.

- US Retail Sales increased 3.0% month-on-month —120 basis points better than expected.

- US NY Empire State Manufacturing Index came out -5.8, suggesting decreasing business conditions —12.2 points better than expected.

- Bitcoin passed 24,000 USD.

- CAC-40 rose to a new all-time high.

- US PPI rose 6% year-on-year —60 basis points better than expected.

- US Core PPI rose 5.4% year-on-year —50 basis points better than expected.

- US Philadelphia Manufacturing Index came out -24.3 —16.9 points better than expected.

- President of the St.Louis FED, James Bullard, said inflation remains too high despite recent deflationary data.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -0.5%

S&P 500 = -0.5%

NASDAQ = -0.09%

RUSSELL 2000 = 1.4%

Gold = -0.8%

Silver = -0.6%

Oil = -3.5%

The weekly performance of S&P 500 Stocks

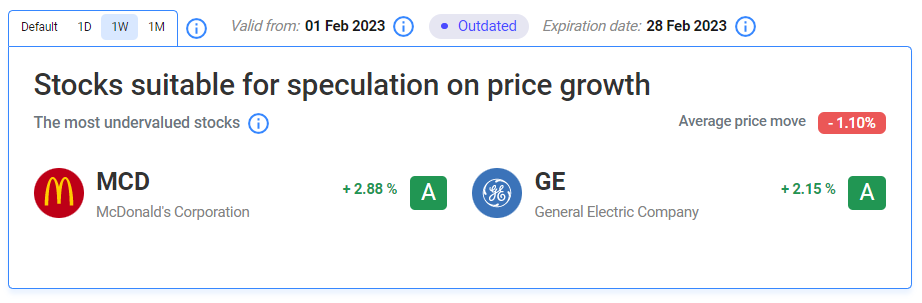

Let’s look at the most undervalued stocks listed on our website:

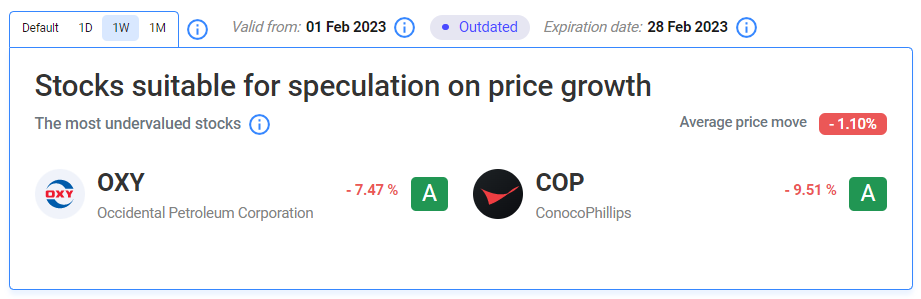

Our Two Least Performing Stocks:

The main reason(s) for the decline in OXY: It was basically a correction after the surge in the last week.

The main reason(s) for the decline in COP: Hawkish comments and the decline in oil prices paved the way for its bad performance (like the other commodities and the energy sector as can be seen above) this week.

TIL: What is Stagnation?

Stagnation is a lengthy period during which it is limited or no progress in an economy, often indicated by extended periods of high unemployment. When the gross domestic product (GDP) shows a growth rate of less than 2-3% annually, it is considered stagnation. Stagnation can manifest at the macroeconomic level or within specific businesses or industries. The condition of stagnation could be either a temporary state resulting from a recession in growth, a short-term economic disruption, or a component of a long-term structural issue with the economy.

Important data/ decisions that will be published next week:

The PCE Price Index and the Core PCE Price Index

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.