The AP on the Street 6th week of 2023

The AP on the Street 6th week of 2023

The last week was relatively neutral for DOW but quite harsh for the other more growth-focused benchmarks. Oil bounced back after its terrible performance one week before the previous week.

This week, there are the CPI and the Core CPI, Retail Sales, NY FED Manufacturing Index, the PPI and the Core PPI, and Philadelphia Manufacturing FED Index. So, let’s take a look at what happened last week:

- Dell announced a layoff for 6500 people, roughly ~5% of its employees.

- Turkey and Syria had the two most enormous earthquakes in their history since 1939, an M7.7 and an M7.6, in the border region called “Kahramanmaras.” — Combined death toll passed 20,000.

- Central Bank of Australia hiked the rate by 25 basis points —making it 3.35%.

- Germany’s industrial production declined 3.1% month-on-month —240 basis points worse than expected.

- The SoftBank group reported a ~$6 billion loss in Q3.

- Baidu shares soared after confirming plans to launch a ChatGPT-style bot.

- Boeing announced a layoff for 2000 people.

- Zoom announced a layoff for 15% of its employees.

- Chairman Powell said if the data comes stronger than expected, the FED may increase the rates more.

- Chairman Powell said they expect a substantial decline in inflation during 2023.

- Chairman Powell said the US is at the beginning of the disinflation process and added that the FED should keep the rates at a restrictive level during this period.

- Chairman Powell said he expects more hikes in the inflation war.

- Istanbul Stock Exchange is now closed for the first time since the last disaster in 1999 amid the earthquake sell-off.

- Google shares plunged after the “Bard (AI chatbot” glitch —lost $100 billion in market capitalization.

- President of the Minneapolis FED, Neel Kashkari, said that he expects the FED funds to go above 5% this year.

- President of the New York FED, John Williams, said the peak rate of 5.25% is still a viable option.

- Disney announced a layoff for 7000 people. Disney shares soared after that.

- Affirm announced a layoff for nearly 20% of its employees.

- Germany’s CPI rose 8.7% year-on-year —20 basis points lower than expected.

- Credit Suisse shares slipped after the annual loss report.

- US Initial Jobless Claims came out as 196,000 —6,000 worse than expected.

- Lyft shares tumbled around 30% at the opening, the most significant drop since the IPO.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

- DOW = 0.1%

- S&P 500 = -0.4%

- NASDAQ = -1.5%

- RUSSELL 2000 = -2.6%

- Gold = -0.5%

- Silver = -1.2%

- Oil = 8.4%

The weekly performance of S&P 500 Stocks

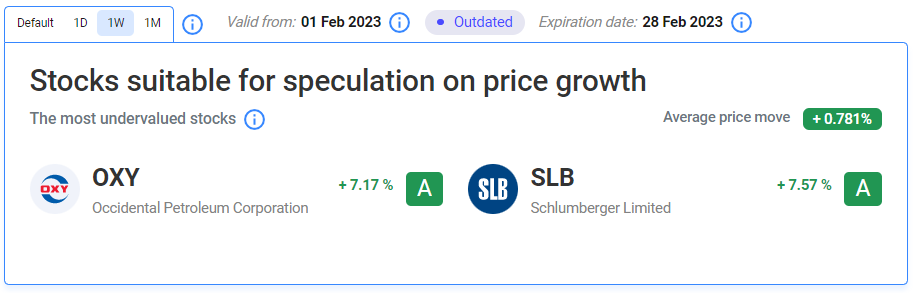

Let’s look at the most undervalued stocks listed on our website:

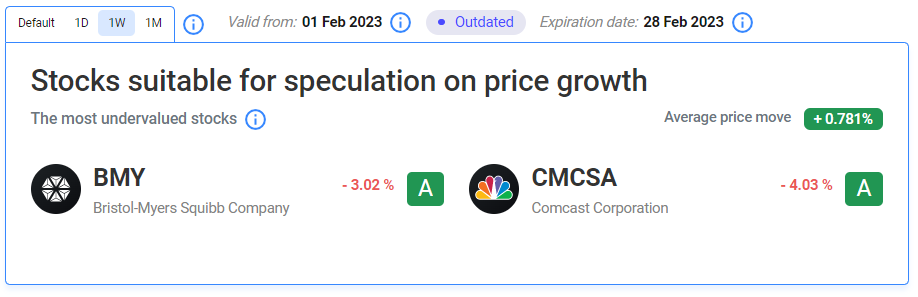

Our Two Least Performing Stocks:

The main reason(s) for the decline in BMY: It was basically a correction for its last week’s performance.

The main reason(s) for the decline in CMCSA: We could not find a reason other than the discussions about the sale of HULU by Disney. Since Comcast owns 33% of HULU, a sale deal may dilute or damage their stake.

TIL: What is Sharpe Ratio?

The Sharpe ratio evaluates the success of a financial investment in relation to a risk-free benchmark asset. Usually, a higher number is better. It calculates this by determining the difference between the investment returns and the risk-free asset returns and dividing it by the standard deviation. This ratio reflects the additional return an investor gains per unit of additional risk taken.

Important data/ decisions that will be published next week:

The CPI and the Core CPI, Retail Sales, NY FED Manufacturing Index, the PPI and the Core PPI, and Philadelphia Manufacturing FED Index. Also, there are a few FOMC members’ speeches.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.