The AP on the Street 5th week of 2023

The AP on the Street 5th week of 2023

The last week was relatively neutral for DOW, but the other more growth-focused benchmarks had an excellent rally due to the slightly dovish comments.

Contrary to the last week, this week will be pretty calm. There are only the Initial Jobless claims and speeches of various FOMC members. So, let’s take a look at what happened last week:

• Euro Zone GDP rose 1.9% year-on-year —30 basis points worse than expected.

• Euro Zone GDP rose 0.1% quarter-on-quarter, avoiding recession. —20 basis points better than expected.

• Exxon shares tumbled after worse-than-expected revenue.

• Mcdonald’s shares dropped despite beating the estimates due to the warning of more persistent inflation.

• Pfizer shares tumbled after the 2023 sales outlook due to the lack of demand for COVID-19 vaccines.

• Caterpillar shares slipped after Q4 earnings came out weaker than expected.

• GM shares soared after better-than-expected Q4 earnings.

• UPS shared jumped after a better-than-expected earnings report and a $5 billion buyback plan.

• According to Reuters, Bed Bath & Beyond is preparing to file for bankruptcy.

• US Consumer Confidence came out at 107.1 —1.9 points worse than expected.

• US Chicago PMI came out 44.3 —0.7 points worse than expected.

• Paypal announced a layoff of 2000 employees, roughly 7% of its workforce.

• Snap shares tumbled over 14% after the worse-than-expected Q4 revenue report.

• AMD shares soared after Q4 earnings came out better than expected.

• Euro Zone CPI rose 8.5% year-on-year —50 basis point lower than expected.

• United States Nonfarm Employment came out as 106,000 —72,000 less-than-expected.

• US JOLTs came out 11.012M —0.762M, better than expected.

• US Manufacturing PMI came out as 47.4 —0.6 points worse than expected.

• The Federal Reserve increased the interest rate by 25 basis points, making it 4.75% nominally —the highest level since September 2007.

• Chairman Powell said the economy still needs time to feel the full effects of the rapid tightening.

• Chairman Powell said the rates are still not sufficiently restrictive enough, and the inflation is still well above the goal; implying there is still more work to do.

• Chairman Powell said that they have no incentive and desire to overtight.

• Chairman Powell said that the FOMC committee is still discussing a couple more hikes to make the rates restrictive enough.

• Chairman Powell stated that the FED has a different forecast from the markets and said considering the outlook, investors should not wait for them to cut rates this year.

• US Dollar plunged to its lowest level since April 2022.

• Meta shares surged after the Q4 sales report and the announced buyback plan —climbed back above $500 billion market capitalization.

• Deutsche Bank beat Q4 earnings expectations as the revenue increased by the higher interest rates.

• Shell reported its highest annual profit ever — around $40 billion.

• Gautam Adani lost $104 billion in net worth after the Hindenburg Research incident.

• Bank of England hiked the interest rate by 50 basis points, making it 4%.

• The ECB raised the interest rate by 50 basis points, making it 3%.

• Chairwoman Lagarde said the rates still have to rise significantly.

• US Non-Manufacturing PMI came out 55.2 —5.2 points better than expected.

• US Services PMI came out 46.8 —0.2 points better than expected.

• US Unemployment Rate went down to 3.4% —20 basis points lower than expected.

• Alphabet shares plunged after revenue missed the estimates.

• Amazon shares tumbled due to weak guidance, despite beating Q4 revenue expectations.

• Apple shares went down after reporting its first earnings miss since 2016.

• Stocks sunk on the last trading day, after the unexpectedly high jobs report and weak tech earnings.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 0.0003%

S&P 500 = 2.0%

NASDAQ = 4.3%

RUSSELL 2000 = 4.7%

Gold = -3.2%

Silver = -5.7%

Oil = -6.1%

The weekly performance of S&P 500 Stocks:

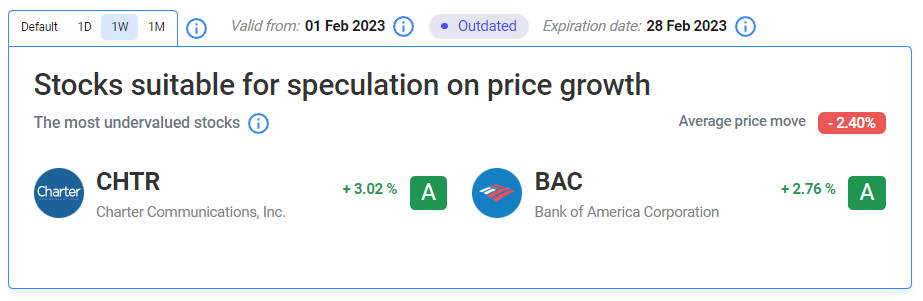

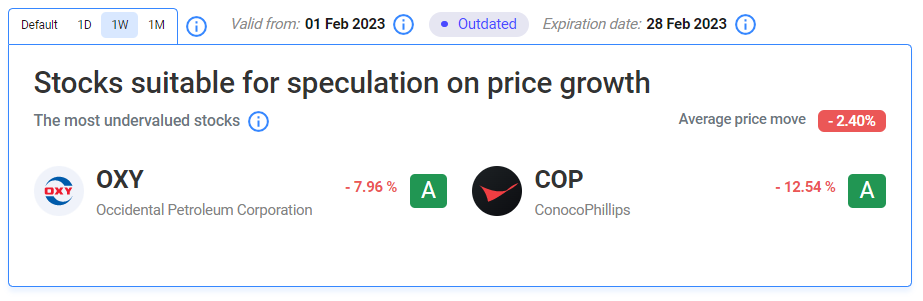

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

The main reasons for the decline in COP were the earnings miss and the drop in oil prices.

The main reason for the decline in OXY stock was the drop in oil prices.

TIL: What is a Hedge Fund?

A hedge fund is a type of fund that gets money from various investors. It invests in assets and implements strategies, including short selling, leverage, derivatives, et cetera, to enhance returns through trading, portfolio building, and risk management methods.

Important data/ decisions that will be published next week:

Initial Jobless claims and speeches of various FOMC members.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.