The AP on the Street 4th week of 2023

The AP on the Street 4th week of 2023

The last week was pretty ambiguous. The market had a positive week.

This week will be extremely-crucial. We have the Chicago PMI, Consumer Confidence, JOLTs, ISM Manufacturing/ Non-Manufacturing PMI data, and most importantly, Unemployment rate and FOMC Interest Rate decision.

So, let’s take a look at what happened last week:

- EURUSD parity rose above 1.09 amid more dovish FED expectations.

- Spotify laid off nearly six percent of its employees.

- Salesforce soared after getting a multibillion-dollar investment from Elliot Management.

- Microsoft announced a 10 billion dollar investment package for OpenAI

- Gold rose to its highest level since April 2022.

- 3M announced a layoff for 2500 people due to its tumbling profits.

- US January Services PMI rose to 46.6 — 1.6 points better than expected.

- New York Stock Exchange halted some stocks due to a glitch happened.

- Microsoft soared after better-than-expected Q2 results.

- Boeing stock tumbled after worse-than-expected Q4 results.

- Bank of Canada increased the interest rate by 25 basis points, implying no more hikes.

- IBM recorded better-than-expected Q4 results and announced a layoff for 4000 people.

- Chevron announced a $75 billion stock buyback and dividend boost.

- Natural Gas tumbled and fell to its lowest level since April 2021.

- Meta reinstated Trump’s Facebook and Instagram accounts.

- Adani Group stocks plunged after Hindenburg Research’s bombshell report.

- Tesla Q4 earnings beat expectations.

- US Q4 GDP rose 2.9% quarter on quarter —30 basis points better than expected.

- US Core PCE prices rose 4.4% year on year, as expected.

- Tesla rallied after Q4 earnings, and market capitalization rose above $500 billion.

- Bed Bath & Beyond tumbled after it admitted the company is, in fact, insolvent.

- BB&B said it received a default notice from JP Morgan Chase.

- Buzzfeed jumped around %305 after it announced that it would use ChatGPT to help create content.

- Intel stock plunged after Q4 earnings miss.

- Visa stock surged after better-than-expected Q1 results.

- Bitcoin surged above $23,000.

Overall Market Indexes & Commodities Moves (Weekly)

DOW = 1.6%

S&P 500 = 2.7%

NASDAQ = 3.7%

RUSSELL 2000 = 2.2%

Gold = 0.5%

Silver = 2.5%

Oil = -2.9%

The weekly performance of S&P 500 Stocks

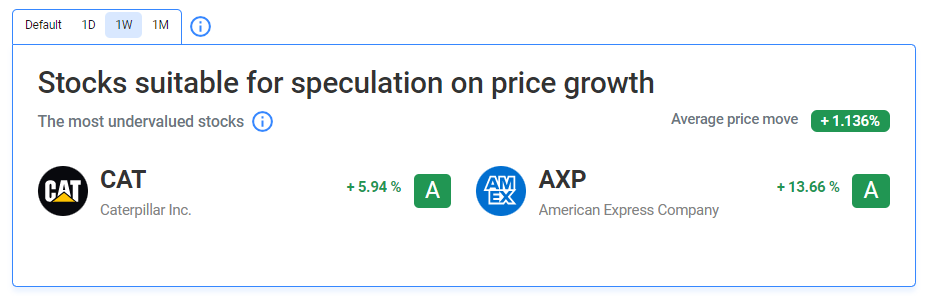

Let’s look at the most undervalued stocks listed on our website:

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

Our Two Least Performing Stocks:

The main reasons for the decline in AMGN stock were US Senator Elizabeth Warren’s concerns about the company’s recent deal and the price target getting lowered by a few analysts.

The main reasons for the decline in AMGN stock were US Senator Elizabeth Warren’s concerns about the company’s recent deal and the price target getting lowered by a few analysts.

The main reason for the decline in NEE stock was its revenue and guidance came out worse than analysts expected.

TIL: What is a share buyback?

A company initiates a stock buyback if it wants to make its stock more appealing to investors. When it does this, it buys back some of its own shares using its cash. Since the company cannot own itself, those shares are mainly deleted. This makes the remaining stocks worth more. It can also help prevent hostile takeovers as well.

Important data/ decisions that will be published next week:

The Chicago PMI, Consumer Confidence, JOLTs, ISM Manufacturing/ Non-Manufacturing PMI data, and most importantly, Unemployment rate and FOMC Interest Rate decision.

Next week will be one of the most critical weeks in this quarter. This time, the FED decision will set the course for the rest of the quarter. Markets are waiting for 25 basis points; however, FED’s comments would be more critical rather than the hike itself.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.