The AP on the Street 40th week of 2023

The AP on the Street 40th week of 2023

This week is different. We would like to introduce revolutionary changes in content provided to you, our beloved readers. Our new approach is based on trending factors and factor analysis.

Why do we change it? We have evaluated that you can find most of the market news, as we had been providing in the previous APs on the Street, elsewhere.

So RIP: “What happened last week”, “Overall Market Indexes & Commodities Moves”, “The Weekly Performance of S&P 500 Stocks (market updates)”, “Our Two Most and Least Performing Stocks”, “Today I Learned”, and most probably the “TAOTS” name.

What is our unique content proposal? Information about factors and their impact on the price moves of stocks. Let’s focus on factors!

Welcome: Trending factors, Factor decay (if there is some), Factor-based news and articles.

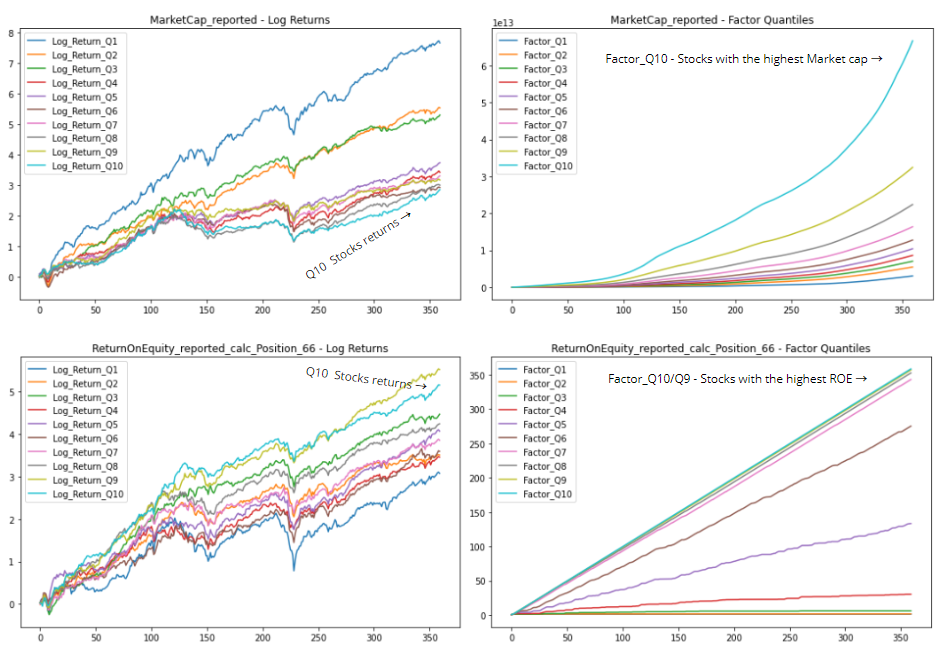

Stay tuned! Next week you will receive the first batch of information about the factors. As a first tasting, look at the behavior of the MarketCap and ROE factors between 1990 – 2019.

Growth factor = Return on Equity. The quantiles composed of stocks with the highest ROE = Factor_Q10+Q9 grows the fastest. Turquoise and beige lines, blended in the bottom right part of the picture.

Introduction to factor investing

Factor investing is an intriguing approach to designing a strategy that has gained traction among both retail and institutional investors. By focusing on specific characteristics, or „factors “, investors aim to achieve superior returns.

What factors are the best factors for factor investing?

There are several models such as a widely used Fama-French three-factor model utilizing three factors, size of firm, book-to-market-values, and excess return on the market. But the correct answer to the question „What are the Best Factors for Factor Investing“ is that the „best“ factors are constantly changing.

How to use information about the importance of the factor?

Analysts using factors for building their investment portfolios and products get valuable insight into the factor’s impact on real price moves. Very often the factors act exactly opposite to what theory and human reason say. And even on a very long-time series.

We provide not only information on how the factor influences the whole stock’s universe but also the impact on every single stock. So that analysts can see that for instance APPL stock is strongly affected by the selected factor. But on the other hand, the same factor has no real impact on the price moves of NVDA stock.

How do we know that?

We have been running our own multi-factor asset pricing model (APM) since 2020, with satisfactory results. For the purposes of understanding how factors influence asset price, we have developed unique software. Our application tracks more than 3000 factors and provides revolutionary information about their behavior in the selected time period.

Read more about the complexities of factor investing and data-driven insights which help to make more informed investment choices.