The AP on the Street 28th week of 2023

The AP on the Street 28th week of 2023

Last week we saw a bull run, with all of the indexes and the commodities we cover in green.

This week we have the NY FED PMI and Philadelphia FED PMI. So, let’s take a look at what happened last week:

- US10YR fell below 4%.

- Dollar Index fell below 100.

- US CPI rose 3.0% year on year —10 basis points lower than expected.

- US Core CPI rose 4.8% year on year —20 basis points lower than expected.

- Bank of Canada raised the interest rates by 25 basis points, as expected —thus making it 5.00%.

- Nvidia stock rose to a new all-time high.

- NASDAQ rose to a new 52-week high.

- US PPI rose 0.1% year on year —30 basis points lower than expected.

- US Core PPI rose 2.4% year on year —20 basis points lower than expected.

- St. Louis FED President James Bullard will step down in August after 33 years.

- JP Morgan beat the estimates for Q2 earnings and revenue.

- Wells Fargo beat the estimates for Q2 earnings and revenue.

- POTUS Biden forgives $39 billion in student debt for more than 800,000 borrowers.

- Threads daily users are down 20% from Saturday, and user time spent is down 50%.

- AT&T closes at the lowest level since 1994.

- The investigation into Credit Suisse will not release its files for 50 years until the year 2073, and they will remain confidential until then.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 1.7%

S&P 500 = 2.2%

NASDAQ = 3.6%

RUSSELL 2000 = 2.6%

Gold = 1.3%

Silver = 7.6%

Oil = 1.9%

The weekly performance of S&P 500 Stocks

Earnings Section:

Next week, from our long top 20 stocks, we will have earnings for the following tickers:

1. GE (July 25th)

2. DOW (July 25th)

3. DHR (July 25th)

4. MMM (July 25th)

5. BA (July 26th)

6. BMY (July 27th)

7. MCD (July 27th)

8. INTC (July 27th)

9. CVX (July 28th)

DOW: Dow Inc. is a materials science company that provides solutions for packaging, infrastructure, mobility, and consumer applications. It operates through three segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings.

It currently stands at 14th place in our top 20 long stocks due to its good amount of points from the CCI indicator. CCI (Commodity Channel Index) compares the present and historical price data to determine whether an asset is overbought or oversold.

Last quarter it managed to beat its EPS estimates of 0.36 estimated and 0.58 actual. This quarter analysts increased the estimation for the EPS by estimating a 0.71 EPS (a 20% hike compared to the last actual figure).

We will see how it will affect our decomposed score after the earnings announcement.

GE: General Electric (GE) is a multinational conglomerate that operates in various industries, including aviation, healthcare, power, renewable energy, and finance. The company was originally incorporated in 1892 and is headquartered in Boston, Massachusetts.

It currently stands in 3rd place in our top 20 long stocks due to its good amount of points from the Momentum indicator. The momentum indicator measures the speed at which a stock price changes to determine whether its price will continue to rise or fall. Momentum measures the speed at which a stock’s price changes. High positive momentum indicates a great chance that a stock’s price will continue in its upward trend.

Last quarter it managed to beat its EPS estimates of 0.14 estimated and 0.27 actual. This quarter analysts increased the estimation for the EPS by estimating a 0.46 EPS (a 53% hike compared to the last actual figure).

We will see how it will affect our decomposed score after the earnings announcement.

Important data/ decisions that will be published next week:

The NY FED PMI and Philadelphia FED PMI

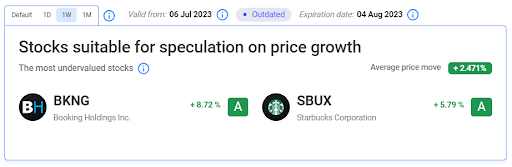

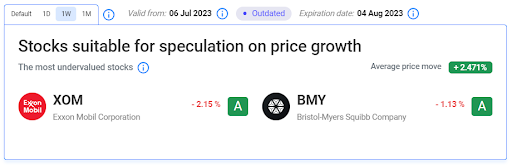

Let’s look at the most undervalued stocks listed on our website:

Our Two Most Performing Stock:

Our Two Least Performing Stocks:

The main reason(s) for the decline in BMY:

We could not find a particular reason for BMY to decline.

The main reason(s) for the decline in XOM:

XOM stock, again, went down due to a business update from the company. They expect way lower earnings than expected for the second quarter. The main culprit in this expected decline is the downward trend in natural gas prices.

TIL: What is Dollar Index?

The US Dollar Index (USDX, DXY) is an index that measures the value of the US dollar relative to a basket of foreign currencies. It is used to track the strength of the dollar against other major currencies. The index was originally developed by the US Federal Reserve in 1973 and is now calculated and published by ICE (Intercontinental Exchange, Inc.).

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.