The AP on the Street 27th week of 2023

The AP on the Street 27th week of 2023

The last week was quite bearish, with most of the indexes being red; however, the commodities we covered were mostly in green. This week, for the first time in TAOTS history, we will have more US-centric news and our prediction’s earning sections in this article.

This week we have the CPI, Core CPI, the PPI, and Core PPI. So, let’s take a look at what happened last week:

- US ISM Manufacturing PMI came out as 46 points —1.2 points lower than expected.

- Tesla shares rose as quarterly deliveries came better than expected.

- Reserve Bank of Australia cuts the interest rate by 25 basis points, thus making it 4.10% —as expected.

- Cocaine was found at the White House; the suspect is unknown.

- Russia and Ukraine accused each other of plotting an attack on a nuclear plant.

- A federal judge blocked Biden administration officials from contacting social media companies to censor.

- Saudi Arabia says new oil cuts show teamwork with Russia is strong.

- FED Minutes showed that some of the FOMC members favored a hike but went ahead with a pause.

- FED Minutes showed that almost all FED members see future rate hikes amid “unacceptably” high price inflation.

- ChatGPT’s growth shows its first decline in traffic since its launch.

- The US10YR yield rose above 4%, the highest level since March.

- European stocks fell after hawkish FED minutes.

- US2YR yield rose above 5.1%, the highest level since 2006. It also caused a huge inversion of 1.1% (US2YR-US10YR).

- US ISM Non-Manufacturing PMI came out as 53.9 —2.9 points lower than expected.

- Twitter sued Meta over the Threads app’s similarities with Twitter.

- The US Unemployment rate came out as 3.6%, as expected.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)DOW = -1.7%

S&P 500 = -0.9%

NASDAQ = -0.8%

RUSSELL 2000 = -1.6%

Gold = 0.7%

Silver = 2.0%

Oil = 4.9%

The weekly performance of S&P 500 Stocks

Earnings Section:

Next week, from our long top 20 stocks, we will have earnings for the following tickers:

1. DOW (July 19th-24th)

2. NFLX (July 19th)

DOW: Dow Inc. is a materials science company that provides solutions for packaging, infrastructure, mobility, and consumer applications. It operates through three segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings.

It currently stands at 14th place in our top 20 long stocks due to its good amount of points from the CCI indicator. CCI (Commodity Channel Index) compares the present and historical price data to determine whether an asset is overbought or oversold.

Last quarter it managed to beat its EPS estimates of 0.36 estimated and 0.58 actual. This quarter analysts increased the estimation for the EPS by estimating a 0.71 EPS (a 20% hike compared to the last actual figure).

We will see how it will affect our decomposed score after the earnings announcement.

NFLX: Netflix, Inc. is a company that provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices.

It currently stands at 12th place in our top 20 long stocks due to its good amount of points from the Momentum indicator. The momentum indicator measures the speed at which a stock price changes to determine whether its price will continue to rise or fall. Momentum measures the speed at which a stock’s price changes. High positive momentum indicates a great chance that a stock’s price will continue in its upward trend.

Last quarter it managed to beat its EPS estimates of 2.86 estimated and 2.88 actual. This quarter analysts increased the estimation for the EPS by estimating a 2.84 EPS (a 1.4% cut compared to the last actual figure).

We will see how it will affect our decomposed score after the earnings announcement.

Important data/ decisions that will be published next week:

FOMC members’ speeches, the PCE Price Index, and the Core PCE Price Index

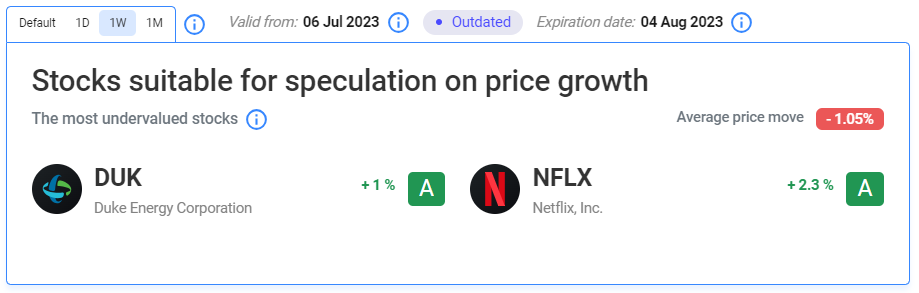

Let’s look at the most undervalued stocks listed on our website:

Our Two Most Performing Stock:

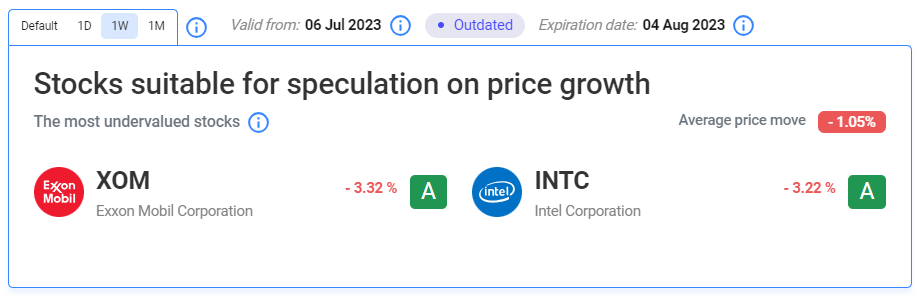

Our Two Least Performing Stocks:

The main reason(s) for the decline in INTC:

INTC stock mostly went down due to expectations of a bad earnings call. Current estimates for EPS is -0.04; it would make a year-over-year decline of 113.79%

The main reason(s) for the decline in XOM:

XOM stock went down due to a business update from the company. They expect way lower earnings than expected for the second quarter. The main culprit in this expected decline is definitely the downward trend in natural gas prices.

TIL: What is free cash flow per share?

Free cash flow per share (FCF) is a measure of a company’s financial flexibility that is determined by dividing free cash flow by the total number of shares outstanding. This measure serves as a proxy for measuring changes in earnings per share. It shows how much cash a company has left after funding its core business and maintaining its capital assets, calculated per share of stock.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.