The AP on the Street 26th week of 2023

The AP on the Street 26th week of 2023

The last week was quite bullish, with most of the indexes and commodities we cover being in green except gold.

This week we have a holiday on the 4th of July (Independence Day), ISM Manufacturing, FED Minutes, JOLTs, and most importantly the Unemployment Rate. So, let’s take a look at what happened last week:

- Tesla shares fell in the most significant day drop.

- China Premier Li Qiang said the government will take steps to boost demand.

- ECB Chairwoman Christine Lagarde says inflation is still too high to declare victory.

- Robinhood will lay off 7% of its workforce.

- Electronic Vehicle company Lordstown Motors files for Chapter 11 bankruptcy.

- US CB Consumer Confidence came out as 109.7 points —5.7 points better than expected.

- Apple stock rose to a new all-time high, again. Passed the $3 trillion market capitalization.

- Nvidia fell down after the potential chip export restrictions.

- Federal Reserve Chairman Jerome Powell says he expects two more rate hikes.

- Chairman Powell said that he does not rule out rate hikes at upcoming meetings.

- Chairman Powell said that the process of getting inflation to 2% has a long way to go.

- ECB Chairwoman Christine Lagarde said she is not considering a rate pause at the moment.

- Spain’s CPI rose 1.9% year on year —20 basis points lower than expected.

- Swedish Central Bank increased the interest rates by 25 basis points, as expected, thus making it 3.50%.

- Germany’s CPI rose 6.4% year on year —10 basis points higher than expected.

- Nike missed its earnings estimations first time in 3 years after the price cuts.

- France’s CPI rose 4.5% year on year —10 basis points lower than expected.

- Euro Zone CPI rose 5.5% year on year —10 basis points lower than expected.

- Euro Zone Core CPI rose 5.4% year on year —10 basis points lower than expected.

- United States PCE Price Index rose 3.8% year on year —80 basis points lower than expected.

- United States Core PCE Price Index rose 4.6% year on year —10 basis points lower than expected.

- French Government deployed a massive police force and armored vehicles to deal with huge violent riots.

- Elon Musk temporarily restricted the number of tweets each account can see on Twitter.

- PIMCO says that they are preparing for a “harder landing” for the global economy.

- US Supreme Court (SCOTUS) blocked student loan relief and outlawed affirmative action.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 1.9%

S&P 500 = 2.0%

NASDAQ = 1.6%

RUSSELL 2000 = 2.6%

Gold = -0.3%

Silver = 0.09%

Oil = 1.8%

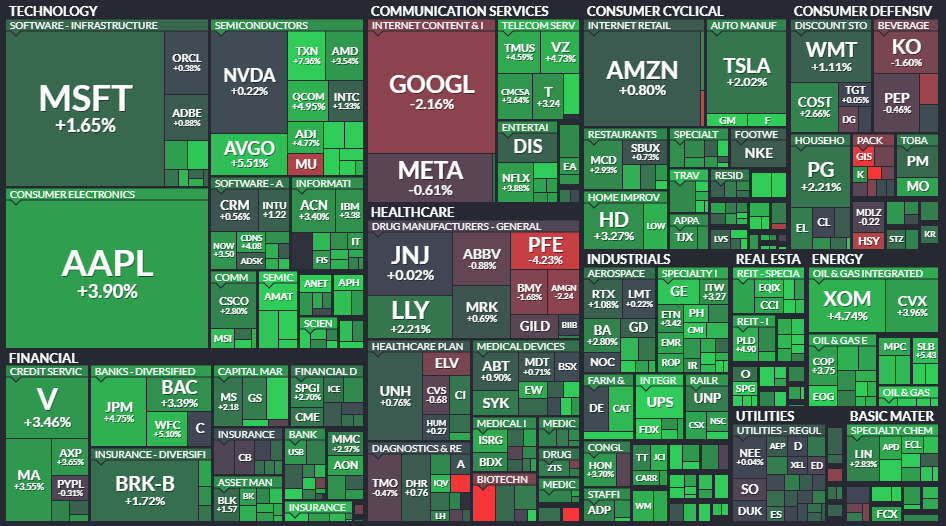

The weekly performance of S&P 500 Stocks

TIL: What is the “4th of July”?

The 4th of July is a federal holiday in the United States that celebrates the nation’s independence from Great Britain. It marks the anniversary of the Declaration of Independence, which was adopted by the Continental Congress on July 4, 1776, declaring that the 13 colonies were free and sovereign states.

Important data/ decisions that will be published next week:

ISM Manufacturing, FED Minutes, JOLTs, and most importantly the Unemployment Rate

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.