The AP on the Street 24th week of 2023

The AP on the Street 24th week of 2023

Last week, as everyone pretty much expected, the FED paused the rate hikes. SPX, NASDAQ, and Oil soared; the other indexes and commodities we usually cover were sideways. This week starts with the Juneteenth Holiday.

We have some FOMC members’ speeches, Services PMI and Manufacturing PMI this week. So, let’s take a look at what happened last week:

- George Soros handed his fund over to his son.

- JP Morgan will $290 million in Epstein settlements.

- Ray Dalio says US Treasury Bond is a risky investment, and equities will probably do better than bonds.

- China is considering a broad stimulus package to reignite its economy with rate cuts and property subsidies.

- US CPI rose 4.0% yearly —10 basis points lower than expected. The lowest level since March 2021, suggesting a cooldown period for price inflation.

- US Core CPI rose 5.3% year on year, as expected.

- Treasury Secretary Janet Yellen said they expect a slow decline in USD as the reserve currency.

- Germany’s DAX index rose to a new all-time high.

- US PPI rose 1.1% year on year —40 basis points lower than expected

- US Core PPI rose 2.8% year on year —10 basis points lower than expected

- US Federal Reserve maintained its current interest rate, 5.25% —as expected. The decision on FOMC was unanimous. However, despite the rate hike, the speech was hawkish, and they said more tightening is on the horizon. FED forecasts two more hikes ahead.

- NVIDIA stock rose to a new all-time high, gaining the $1 trillion mark back.

- Chairman Powell said the risks of inflation are to the upside, and they are not seeing a lot of progress on Core PCE.

- China’s Youth Unemployment Rate hits a record high, of 20.8%.

- European Central Bank hiked the interest rates by 25 basis points, making it 4.00% —as expected. The highest level since October 2008.

- Empire State Manufacturing Index came out as 6.6 points —9.4 points more than expected.

- Apple shares saw an all-time high.

- Bank of Japan maintained its current interest rate, -0.10% —as expected.

- Microsoft shares saw an all-time high.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 0.9%

S&P 500 = 2.2%

NASDAQ = 2.7%

RUSSELL 2000 = -0.04%

Gold = -0.09%

Silver = 0.2%

Oil = 2.9%

The weekly performance of S&P 500 Stocks

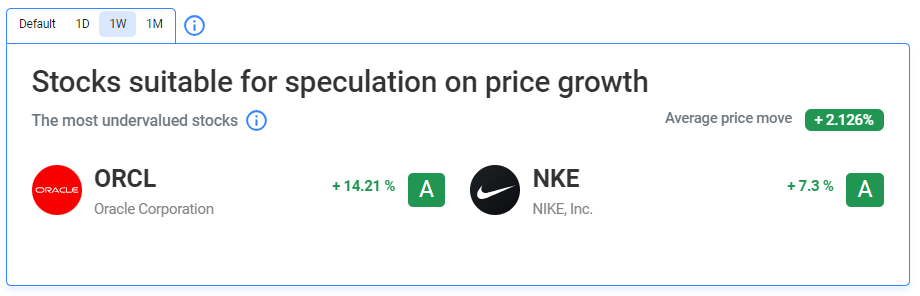

Let’s look at the most undervalued stocks listed on our website:

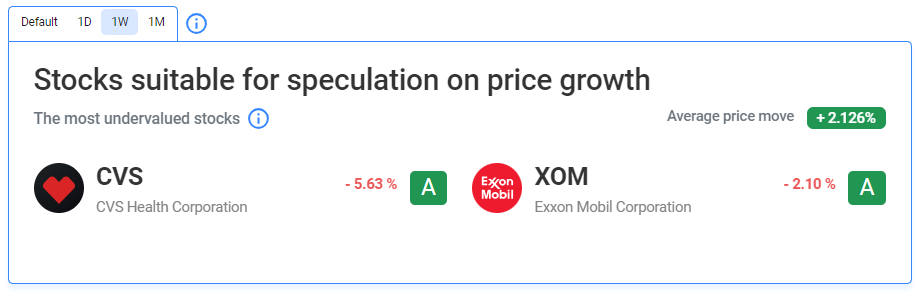

Our Two Least Performing Stocks:

The main reason(s) for the decline in CVS:

CVS Health (CVS) shares fell 6.1% on Wednesday. The decline in the health insurance stock stemmed from comments made by an executive of rival UnitedHealth Group (UNH) at the Goldman Sachs Global Healthcare Conference. Reuters reported that Tim Noel, CEO of UnitedHealthcare Medicare and Retirement, said at the conference that his company is seeing an increase in the volume of elective surgical procedures for older Americans. This trend could drive medical costs higher for health insurers and translate to lower earnings.

The main reason(s) for the decline in XOM:

We could not find a particular reason for XOM to decline.

Important data/ decisions that will be published next week:

FOMC members’ speeches, Services PMI and Manufacturing PMI

TIL: What is Dividend Discount Model (DDM)?

The Dividend Discount Model (DDM) is a method used to estimate a stock’s value based on its future dividends’ present value. It assumes that dividends grow at a constant rate and uses a formula that involves the current dividend, the growth rate, and the required rate of return. It is a common tool for investors who want to compare the market price and the intrinsic value of a stock. It only works for companies that pay dividends.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.