The AP on the Street 23rd week of 2023

The AP on the Street 23rd week of 2023

Last week, pretty much everything we cover except Russell 2000 and Silver had a sideways pattern.

We have quite a critical week this time. We have only the CPI and Core CPI, the PPI and Core PPI, and most importantly FED interest rate decision. So, let’s take a look at what happened last week:

- US ISM Non-Manufacturing came out as 50.3 —1.5 points lower than expected.

- GameStop shares tumbled after an earnings miss.

- Securities and Exchange Commission sued Binance and its CEO for breaking the US securities rules.

- Coinbase tumbled after the SEC lawsuit.

- SEC temporarily froze Binance US assets.

- Saudi Arabia is annoyed with the OPEC members due to the fact that they do not meet their goals, demanding more transparency from Russia.

- Apple showed its new AR/VR headset at the WWDC23 event, called “Apple Vision Pro.”

- Bank of Canada hiked the interest rates by 25 basis points, making it 4.75% —the market was expecting a pause on rates.

- US Services PMI came out as 54.9 —0.2 points lower than expected.

- GameStop fired the CEO and announced more board changes.

- Central Bank of India maintained its current interest rate, 6.50% —as expected.

- Euro Zone Services PMI came out as 55.1 points —0.8 points lower than expected.

- Euro Zone GDP contracted by 0.1% quarter on quarter, 10 basis points lower than expected —officially entering a recession phase.

- Central Bank of Turkey burned billions of dollars to hold the USDTRY last two weeks, according to the CBT reports.

- EU approved €8 billion in subsidies for chip research.

- Swiss National Bank Chairman Thomas Jordan said that the inflation is more persistent than we thought.

- Chairman Jordan added that the Swiss interest rate is relatively low, so it is not a good idea to wait. Giving signals for a rate hike.

- Swiss Franc jumped after SNB Chairman Jordan’s hawkish comments.

- Goldman Sachs COO John Waldron said that a recession may not happen.

- GS COO Waldron also said that the financing environment will become more challenging.

- Economists are betting on two consecutive 25 bps rate hikes from ECB due to the still-hot inflation. The Euro Zone still has a high inflation level despite being in a recession, dismissing the Phillips Curve.

- Saudi Foreign Minister said that the cooperation with China is likely to grow, and the ties with Washington are still robust.

- IMF said that the FED needs to push interest rates higher for a longer period if inflation proves more persistent than expected.

- IMF said that they would update the World Economic Outlook on July 25th, and they are urging the central banks to continue tightening the monetary policy to control inflation.

- IMF also said that the inflation momentum has slowed down in the US but still poses a threat. They urged FED to stay the course on monetary policy.

- POTUS Biden said China’s Belt and Road Initiative transpired into a debt and confiscation program.

- Bank of Canada reiterates rates may stay higher for longer.

- Euro Zone as a whole is in recession, despite ECB Chairwoman Christine Lagarde previously said no EZ country would be in a recession in 2023.

- China’s CPI rose 0.2% year on year, as expected.

- China’s PPI declined 4.6% year on year —30 basis points more than expected.

- Binance suspended USD deposits after the SEC lawsuit.

- UBS secured a $10 billion loss protection agreement from the Swiss Government.

- Russian Ambassador to Turkey said that Russia continues consultations, but no grounds exist for grain deal renewal.

- Russia is about to place nuclear weapons in Belarus after July 7th.

- According to a Wall Street Journal report, North Korea has stolen $3 billion in cryptocurrency heists.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 0.5%

S&P 500 = 0.3%

NASDAQ = 0.04%

RUSSELL 2000 = 2.9%

Gold = 0.6%

Silver = 3.2%

Oil = -3.1%

The weekly performance of S&P 500 Stocks

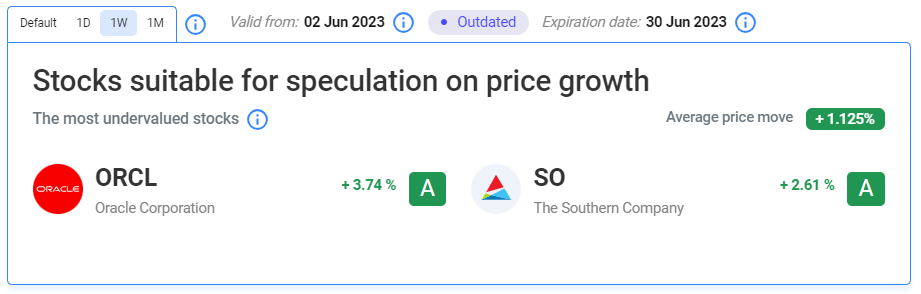

Let’s look at the most undervalued stocks listed on our website:

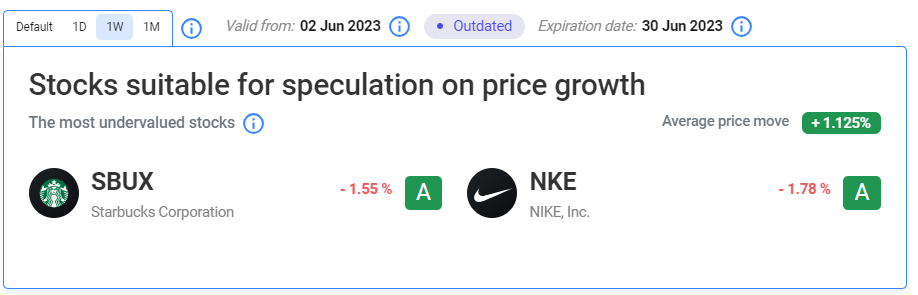

Our Two Least Performing Stocks:

The main reason(s) for the decline in SBUX:

We could not find a particular reason for SBUX to decline. However, recent local rivals in India might have affected its market share in the region, thus indirectly lowering the stock price.

The main reason(s) for the decline in NKE:

Nike broke up with its retail partners and reestablished its relationship with Designer Brands (DBI). Investors probably did not like the supplier change out of nowhere.

Important data/ decisions that will be published next week:

Chicago PMI, JOLTs, ISM Manufacturing PMI, and the Unemployment Rate

TIL: What is Bank for International Settlements (BIS)?

The Bank for International Settlements (BIS) is an international financial institution owned by central banks that fosters international monetary and financial cooperation and serves as a bank for central banks. It carries out its work through its meetings, programs, and through the Basel Process – hosting international groups pursuing global financial stability and facilitating their interaction.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.