The AP on the Street 20th week of 2023

The AP on the Street 20th week of 2023

Last week, we had slightly positive results.

We have Services PMI, Manufacturing PMI, the PCE Price Index, and Core PCE. So, let’s take a look at what happened last week:

- Turkey will hit the polls again on May 28th for the second round of presidential elections since no candidate reached the 50% threshold after the tense election night on May 14th.

- Turkish lira slumped on the black market after the first round results, and banks stopped cash withdrawals on credit cards.

- Istanbul Stock Exchange plunged 7%; afterward, the government halted the transactions immediately.

- Biden is looking for Republican support amid the debt ceiling crisis.

- Atlanta FED President Raphael Bostic said that cutting the rates this year is not his baseline, and it may even have to go up.

- NY Empire State Manufacturing index sunk to -31.8 points —28.1 points lower than expected.

- Former Silicon Valley Bank CEO said the rate hikes and social media craze killed the firm.

- Berkshire Hathaway increased its stake in Capital One Financial, Apple, Citi Group, Occidental Petroleum, and Bank of America.

- US Virgin Islands subpoenaed Elon Musk concerning the Epstein case.

- Morgan Stanley is planning to cut 7% of its Asia jobs.

- Vodafone is planning to cut 11,000 jobs.

- Treasury Secretary Janet Yellen said a potential US default would result in an unprecedented economic and financial storm, thus creating an income shock that could lead to a recession.

- Elon Musk said that “So many conspiracy theories have turned out to be true.”

- Elon Musk said that Tesla is not immune to the tough economy he predicts.

- POTUS Biden cut the Asia trip halfway to come back and discuss the debt ceiling crisis.

- Deutsche Bank agrees to pay $75 million to settle the lawsuit with Epstein victims.

- Philadelphia Manufacturing Index came out -10.4 points —9.4 points better than expected.

- House Speaker McCarthy said that the debt limit deal would be on the House this week, also saying that they were at a much better place than a week before.

- Netflix shares soared after reporting that its ad-supported tier now has millions of active clients.

- Morgan Stanley CEO James Gorman is planning to step down this year.

- Debt Limit talks hit another obstacle after Republican negotiators walked out. White House called them unreasonable.

- According to a CNN report, Janet Yellen told Bank CEOs that more mergers might be necessary

- Republican negotiators said no progress in debt ceiling talks.

- Instagram is planning to release a text-based app that can compete with Twitter.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 0.3%

S&P 500 = 1.5%

NASDAQ = 2.8%

RUSSELL 2000 = 1.4%

Gold = -1.7%

Silver = -0.4%

Oil = 0.2%

The weekly performance of S&P 500 Stocks

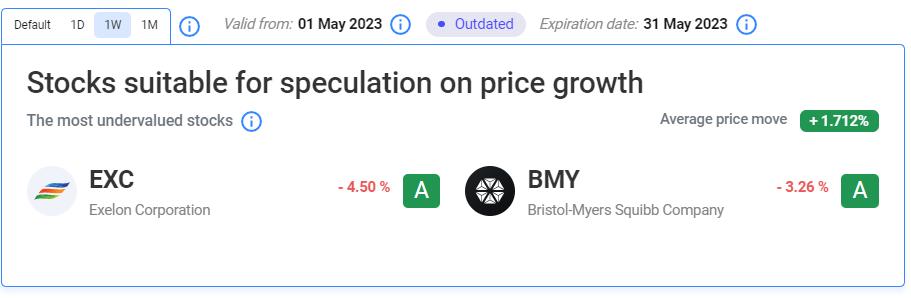

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

The main reason(s) for the decline in EXC:

We could not find a particular reason for EXC to decline other than low EPS expectations for the next quarter.

The main reason(s) for the decline in BMY:

We could not find a particular reason for BMY.

Important data/ decisions that will be published next week:

Services PMI, Manufacturing PMI, the PCE Price index, and Core PCE

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.