The AP on the Street 1st week of 2023

The AP on the Street 1st week of 2023

The first week of 2023 was relatively calm, and the indexes went sideways. Unfortunately, the Santa Claus Rally did not happen.

This week, we have the FED Chairman Powell’s speech and the CPI data. So, let’s take a look at what happened last week:

- Markets were closed on Monday for the New Year break.

- Chine Manufacturing tumbled sharply in December due to COVID

- European gas futures went down to their lowest level since the invasion.

- Germany’s CPI rose to 8.6% year-on-year —50 basis points lower than expected.

- Apple stock fell to a new 52-week low due to the weakening demand. It fell below $2 trillion in market capitalization, one year after being the first company to reach the $3 trillion mark last year in January.

- US Natural Gas fell to its lowest since February 2022.

- Oil prices plunged after the global recession concerns in 2023.

- Tesla stock reached its lowest level since September 2020.

- France’s CPI rose to 5.9% year-on-year —50 basis points lower than expected.

- Euro Zone PPI rose to 27.1% year-on-year —40 basis points lower than expected.

- Services PMI came out 44.7 —0.3 points better than expected.

- The unemployment rate decreased to 3.5% —20 basis points better than expected. Suggesting the job market is still in good shape despite the rate hikes.

- Bed Bath & Beyond shares crumpled 20% after the company warned it might go bankrupt.

- Euro Zone CPI rose to 9.2% year-on-year —50 basis points lower than expected.

- Euro Zone Core CPI rose to 5.2% year-on-year —20 basis points higher than expected.

- Chinese billionaire Jack Ma ceded control of Ant Group.

Overall Market Indexes & Commodities Moves (Weekly)

DOW = 0.9%

S&P 500 = 0.8%

NASDAQ = -0.02%

RUSSELL 2000 = 0.4%

Gold = 0.9%

Silver = -2.5%

Oil = -6.7%

The weekly performance of S&P 500 Stocks

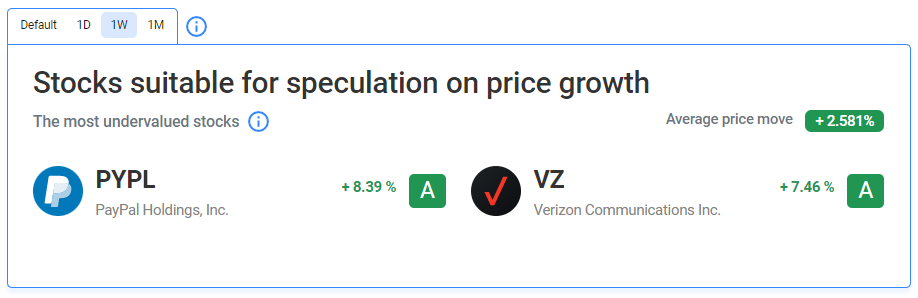

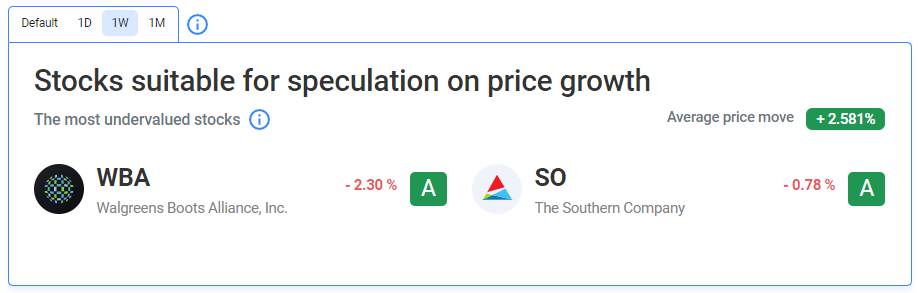

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

The main reason for the decline in WBA stock was that Wallgreens’ sales fell as the demand for COVID-related vaccines/drugs tumbled. Concerning the SO, it went down by 2.5% after the appointment of the new CEO.

TIL: What does a “Blue-Chip” stock mean?

A blue-chip business is one that is well-known, reputable, and financially stable. Blue chips often offer top-notch, extensively used goods and services. Because of their long history of steady and predictable development, blue-chip firms are recognized for being able to withstand downturns and continue to make a profit in the face of challenging economic conditions.

Important data/ decisions that will be published next week:

CPI, Core CPI, Chairman Powell’s Speech

The last week was normal for the investors. We will see how the investors will behave after Powell’s Speech and CPI.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.