The AP on the Street 19th week of 2023

The AP on the Street 19th week of 2023

The last week, we mainly had negative results yet again. Despite the cooling down inflation levels, only NASDAQ was in the green zone.

We have the Empire State Manufacturing Index, and Philadelphia Manufacturing Index. So, let’s take a look at what happened last week:

- Binance paused Bitcoin withdrawals again due to network congestion.

- Pacific Western Bank cuts the quarterly dividend by 95% to 0.01 USD.

- Treasury Secretary Janet Yellen warned about economic chaos if Congress will not raise the debt ceiling.

- The pacWest stock skyrocketed after the revision concerning the dividend.

- Palantir shares soared after a strong AI demand forecast.

- Republican Speaker McCarthy said he opposes extending the debt ceiling.

- US CPI rose 4.9% yearly —10 basis points lower than expected.

- US Core CPI rose 5.5% year on year, as expected.

- POTUS Biden says not he is not ready to invoke the 14th Amendment to avoid a debt default.

- US Government Credit Default Swap levels hit an all-time high amid the debt ceiling crisis.

- China’s CPI rose 0.1% yearly —30 basis points lower than expected. Suggesting an economic slowdown made investors worry about deflation fears.

- China’s PPI declined 3.6% year on year —40 basis points higher than expected. Adding more deflation fear for investors.

- POTUS Biden warns of recession unless Republicans support his debt ceiling plan; however, the US recently had a recession in 2022, and there was already a high chance for a US recession in 2023.

- JP Morgan CEO Jamie Dimon said the debt ceiling crisis could cause panic.

- Janet Yellen said it should be unthinkable for the US to default on its debt.

- Bank of England raised the interest rate by 25 basis points, thus making it 4.50%.

- PacWest Bank reported a decline in deposits by 9.5% in one week.

- JPM CEO Jamie Dimon said the regulators should look at a potential US short-selling ban on banks.

- US PPI rose 2.3% yearly —10 basis points lower than expected.

- US Core PPI rose 3.2% yearly —10 basis points lower than expected.

- PacWest shares collapsed around 30% after reporting the fleeing deposits.

- Disney shares plunged with the most significant one-day decline in six months.

- Elon Musk said he is stepping down as Twitter CEO but will oversee the product. Linda Yaccarino is in talks to be the new CEO.

- Tesla shares soared after the announcement of the CEO change for Twitter.

- Bitcoin hits a two-month low, dropping below $27,000.

- Peloton stock hit an all-time low after recalling more than 2 million bikes.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -1.3%

S&P 500 = -0.3%

NASDAQ = 0.5%

RUSSELL 2000 = -1.3%

Gold = -0.4%

Silver = -6.8%

Oil = –4.0%

The weekly performance of S&P 500 Stocks

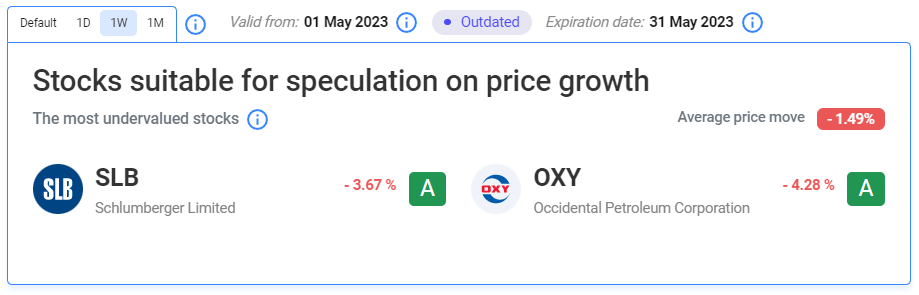

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

Both stocks declined pretty much similarly to the other stocks, so there was not any specific reason.

TIL: What is Earnings per Share (EPS)?

Earnings per Share is a company’s profit divided by the number of outstanding shares of its common stock.

Important data/ decisions that will be published next week:

The Empire State Manufacturing Index and Philadelphia Manufacturing Index

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.