The AP on the Street 14th Week of 2023

The AP on the Street 14th Week of 2023

Again, the last week was good for most of the indexes (except Russell 2000) and commodities.

This week we have the Core CPI, CPI, the Core PPI, and PPI. So, let’s take a look at what happened last week:

- Saudi Arabia will cut oil output by 500,000 barrels a day until December —crude oil soared after that, sparking inflation fears again.

- Tesla shares plunged after delivering fewer vehicles than expected despite the price cuts.

- UBS is planning to cut 36,000 jobs globally after the Credit Suisse deal.

- WWE agreed to merge with UFC, thus creating a new giant company.

- Goldman Sachs raised its Brent Oil forecast to 95$ in December 2023.

- US ISM Manufacturing PMI came out as 46.3 points —1.2 points lower than expected, the weakest level since May 2020.

- Dogecoin soared after Twitter changed its button to a doge picture.

- Apple announced a lay-off for a small number of retail jobs.

- Google will cut down on employee laptops, services, staplers, and other office supplies for savings.

- McDonald’s announced a lay-off for hundreds.

- JPM CEO Jamie Dimon said the banking crisis is not over, and it would cause repercussions for years to come.

- Finland became the 31st member of NATO —Russia warned of counter-measures.

- US JOLTs came out as 9.9 million —0.5 million lower than expected, the lowest level since May 2021.

- Gold reached its highest level since August 2020.

- Silver reached its highest level since April 2022.

- DAX rose to its highest level since January 2022.

- C3 AI sunk after a short seller made accounting fraud allegations.

- Trump pleaded not guilty to 34 felonies of falsifying business records.

- New Zealand Central Bank increased the interest rates by 50 basis points while stating that the inflation is still too high —25 basis points higher than the market estimation, surprising all the investors.

- LVMH CEO Bernard Arnault’s net worth passed the $200 billion mark.

- US Nonfarm payrolls rose by 236000 —3000 lower than expected.

- US ISM Services PMI came out as 51.2 —3.3 points lower than expected.

- US10YR yield fell to 3.2% —the lowest level since September 2022.

- Goldman Sachs got fined $3 million by FINRA due to mismarking 60 million short sales as long.

- Saudi Arabia’s debt rating is upgraded to A+ by Fitch, mentioning the efforts of diversification on a macroeconomic scale.

- Three Republicans will introduce the “Gold Standard Bill” to stabilize the US dollar and inflation by backing it up with gold —aiming to reverse Republican President Nixon’s historic abandonment of the gold standard.

- Alliance Bank’s Q1 deposits fell around 11%.

- Taiwanese President met US House Speaker Kevin McCarthy in California despite Chinese warnings.

- Levi’s shares plunged 16% in one day.

- JPM CEO Jamie Dimon said that the banking crisis had increased the likelihood of a recession.

- Dogecoin fell after Twitter replaced the Shiba Inu with the signature bird again.

- Tesla announced another set of price cuts to increase demand.

- US Markets were closed on Friday due to the Good Friday holiday.

- The US Unemployment rate decreased to 3.5% —10 basis points better than expected.

- US Average Hourly Earnings rose 4.2% year on year —10 basis points lower than expected.

- China plans military drills near Taiwan after the President’s US visit.

- US Bank deposits decreased by almost $300 billion in the last three weeks.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 1.3%

S&P 500 = 0.8%

NASDAQ = 0.1%

RUSSELL 2000 = -1.7%

Gold = 2.1%

Silver = 3.9%

Oil = 7.0%

The weekly performance of S&P 500 Stocks

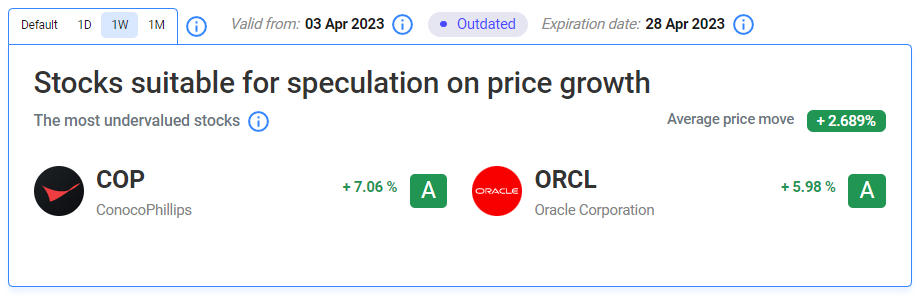

Let’s look at the most undervalued stocks listed on our website:

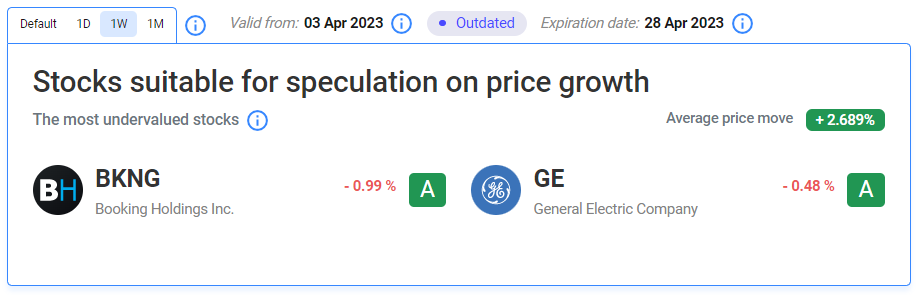

Our Two Least Performing Stocks:

The main reason(s) for the decline in GE: The UK competition regulators are probing French power operator EDF’s deal to buy a nuclear turbine maker from GE, and due to that, GE shares slid slightly. The main reason(s) for the decline in BKNG: We could not find a reason for BKNG stock to decline.

TIL: What is Behavioral Finance?

Behavioral finance is a field of study that examines how psychological factors affect the behavior of investors and financial markets. It challenges the assumption that investors are always rational and act in their own best interest. It also explores how different biases and emotions can influence financial decisions and outcomes.

Important data/ decisions that will be published next week: The Core CPI, CPI, the Core PPI, and PPI

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.