The AP on the Street 13th week of 2023

The AP on the Street 13th week of 2023

Last week was good for most of the indexes and commodities due to relieving news around the world about the financial markets.

This week we have the Manufacturing PMI, JOLTs, Unemployment rate, and Services PMI. So, let’s take a look at what happened last week:

- US bank deposits fell sharply in the last two weeks, around $225 billion.

- The Swiss finance minister said that Credit Suisse would not have survived another day and would have caused a global financial crisis.

- Federal Reserve expanded its balance sheet to its highest level since November —undoing around 60% of the quantitative tightening done.

- Putin said Russia is ready to deploy tactical nuclear arms in Belarus by July.

- Minneapolis FED President Neel Kashkari said other banks have exposure to long-dated treasury bonds and commercial real estate losses.

- First Citizens Bank bought Silicon Valley Bank for $16.5 billion.

- The Chairman of Saudi National Bank resigned for personal reasons. After the controversy about the Credit Suisse incident.

- First Citizens Bank shares jumped around 50% to an all-time high after the deal.

- CFTC is suing Binance and CZ over regulatory violations.

- Markets are now predicting a 51% chance of a rate hike stop and a 48% chance of a 25 basis points hike.

- Alibaba shares soared after the news about the split.

- JP Morgan CEO Jamie Dimon will be deposed in Epstein lawsuits.

- UBS elected the former CEO Sergio Ermotti again.

- US charges FTX Sam Bankman-Fried with paying $40 million in bribes.

- Credit Suisse whistleblowers said that CS has been helping wealthy Americans dodge taxes for years.

- Elon Musk called for a pause in advanced AI tech development.

- Spain’s CPI rose 3.3% year on year —50 basis points lower than expected.

- Germany’s CPI rose 7.4% year on year —10 basis points higher than expected.

- US Core PCE Price Index rose 4.6% year on year —10 basis points lower than expected.

- Disney killed its Metaverse division and fired all of its employees.

- Virgin Orbit is ceasing operations for the foreseeable future.

- Japan’s Core CPI rose 3.2% year on year —10 basis points higher than expected.

- France’s CPI rose 5.6% year on year —10 basis points higher than expected.

- Italy’s CPI rose 7.7% year on year —50 basis points lower than expected.

- Euro Zone CPI rose 6.9% year on year —20 basis points lower than expected.

- Euro Zone Core CPI rose 5.7% year on year as expected, reaching an all-time high number —10 basis points higher than the previous number.

- US PCE Price Index rose 5.0% year on year —10 basis points lower than expected.

- Former US President Trump will surrender Tuesday before New York Court Appearance.

- Chicago PMI came out as 43.8 points —0.4 points higher than expected.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 2.3%

S&P 500 = 2.7%

NASDAQ = 2.8%

RUSSELL 2000 = 2.9%

Gold = 1.9%

Silver = 5.0%

Oil = 3.6%

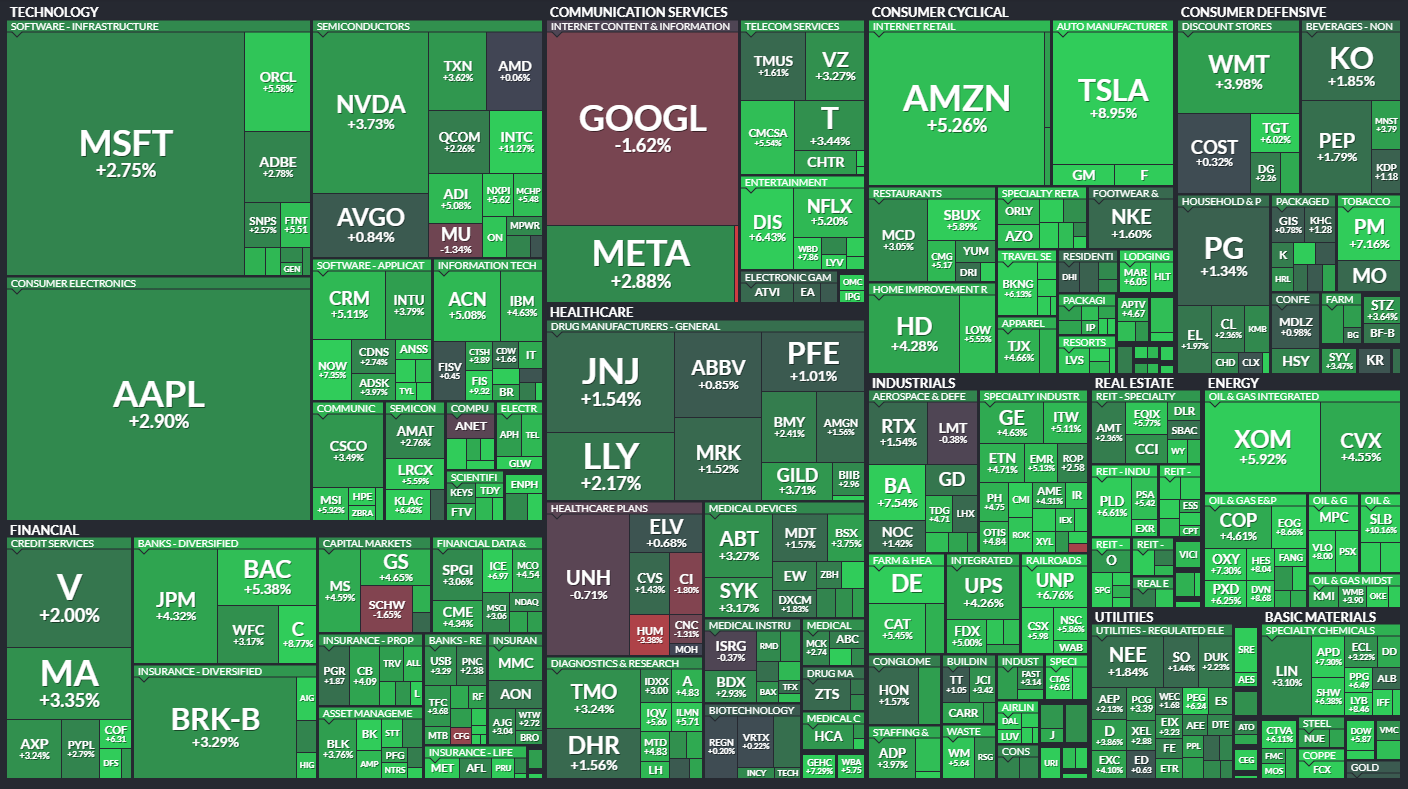

The weekly performance of S&P 500 Stocks

TIL: What is Amortization?

Amortization is a method of spreading an intangible asset’s cost throughout its useful life. Intangible assets are non-physical assets that are essential to a company, such as a trademark, patent, copyright, or franchise agreement. This means that instead of recognizing the entire cost of the asset in the year it was purchased, the cost is spread out over several years. This can help companies better match the cost of the asset with the revenue it generates.

Important data/ decisions that will be published next week:

Manufacturing PMI, JOLTs, Unemployment rate, and Services PMI

The last week was a completely different level. Distressed banks, rate pause anticipations, etc… One can draw parallels between those events and the Great Recession; however, we believe that despite all the horrible things happening, it is still early to talk about a global financial crisis.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.