The AP on the Street 12th week of 2023

The AP on the Street 12th week of 2023

The last week was pretty much a sequel to the one week before. Despite different expectations, we did not see a pause in rate hikes.

This week we have the consumer confidence, Core PCE Price index, Chicago PMI, interest rate decision, and a few FOMC member speeches. So, let’s take a look at what happened last week:

- Credit Suisse deletes $17 billion worth of bonds.

- UBS shares tanked after the CS acquisition.

- Goldman Sachs was expecting a pause for the rate hikes this month.

- Gold passed the $2,000 mark.

- First Republic Bank shares went down even more.

- Amazon announced another lay-off for 9000 employees.

- Senator Elizabeth Warren said the FED failed its job.

- Morgan Stanley CIO Mike Wilson said he still sees a downside risk of around 20%.

- Jamie Dimon is leading talks for First Republic Bank rescue plan discussions.

- ECB President Christine Lagarde said that Euro Zone banks’ exposure to Credit Suisse is limited.

- According to the rumors, the US is studying ways to guarantee all bank deposits.

- Janet Yellen said that the Treasury would offer more support to US banks if needed. After that, First Republic Bank shares went up, as well as the regional banks.

- Gamestop shares soared after shocking quarterly profit.

- UK CPI soared to 10.4% —50 basis points higher than expected, 30 basis points higher than the last number.

- UK Core CPI soared to 6.2% —50 basis points higher than expected, 40 basis points higher than the last number.

- The Federal Reserve increased the rate by 25 basis points, making it 5.00%.

- The FED statement changed “ongoing increases” to “some additional policy firming may be appropriate.”

- Chairman Powell said the process of getting inflation back down has a long way to go, and it will be rough.

- Chairman Powell said that they considered a rate pause, however, the hike was supported by solid consensus.

- Chairman Powell said the credit tightening could mean less work for them.

- Chairman Powell said disinflation is still absolutely occurring in the US.

- Chairman Powell said the FED officials do not see rate cuts this year.

- Chairman Powell stated that if they need to raise rates higher, they will.

- Yellen said that they are not considering a broad increase in deposit insurance. FRB sunk after the comment.

- Yellen said that they never saw deposits flee at the pace they were withdrawn from Silicon Valley Bank.

- The dollar index dropped after FED’s dovish hike.

- Swiss National Bank hiked 50 basis points and said more action might be needed.

- Bank of England hiked 25 basis points, making it 4.25%.

- Janet Yellen said a debt default would undermine the dollar’s reserve currency status; she also added that failure by the government to pay its bills would be economically and financially catastrophic and have a horrendous effect on financial markets.

- Deutsche Bank shares tumbled after a sudden spike in the CDS.

- Money markets price a 25 basis points rate cut by June.

- Christine Lagarde told EU leaders that ECB is fully equipped to provide liquidity to Euro Area financial system if needed.

- US treasury yields fell sharply.

The weekly performance of S&P 500 Stocks

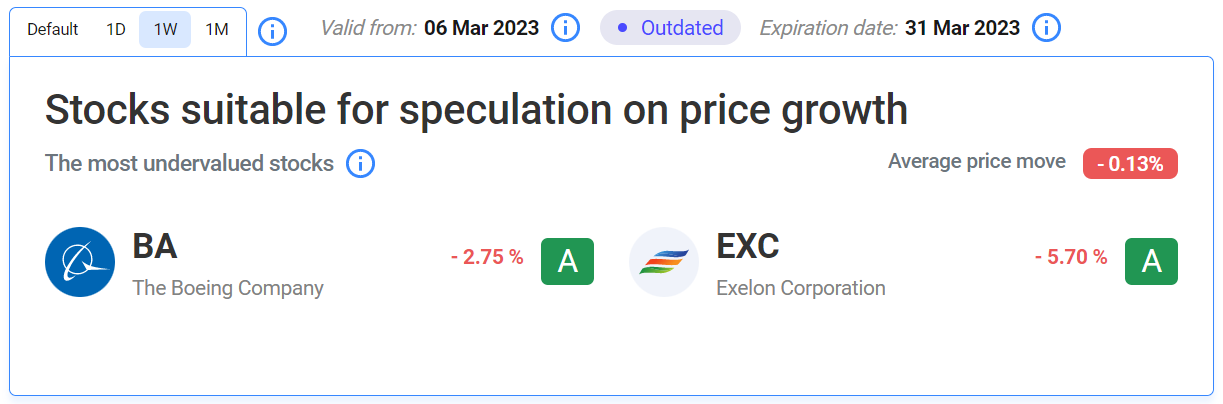

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

TIL: What is Tech Street?

Tech Street is a term used to identify the technology sector, which is further subdivided into areas such as semiconductors, software and gaming, personal computers, data storage, telecom, IT services, internet services, and numerous others. Within Tech Street, you can find prominent companies such as Google, Apple, IBM, Microsoft, Texas Instruments, and Meta (previously known as Facebook).

Important data/ decisions that will be published next week:

The consumer confidence, Core PCE Price index, Chicago PMI, interest rate decision, and a few FOMC member speeches.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.

Written on 24/03/2023.