The AP on the Street 10th week of 2023

The AP on the Street 10th week of 2023

The last week was terrible. Chairman Powell’s hawkish-like comments and the failure of Silicon Valley Bank led to a plunged market.

This week, there are the CPI and the PPI. So, let’s take a look at what happened last week:

- Tesla cut its prices of cars.

- Meta announced another lay-off for thousands (could reach 13% of its workforce).

- Chairman Powell said that the economy’s strength suggests a higher-than-expected terminal rate.

- Chairman Powell said the historical record warns strongly against premature loosening (concerning the war with inflation).

- Chairman Powell said they would stay in the course until the job was done.

- Chairman Powell said rates are likely to go higher than expected.

- US2YR passed the 5% mark for the first time since 2007 after the testimony.

- The dollar soared after the hawkish comments.

- JOLTs came out 10.824 million —324,000, better than expected.

- President Biden is insisting on a 25% billionaire tax.

- Xi Jinping has been elected for his third term as president.

- Bitcoin went under the $20,000 mark.

- US Unemployment rose to 3.6% —20 basis points higher than expected.

- Silicon Valley Bank stocked crushed, and the bank is closed by California Regulators —seized by the FDIC.

- Janet Yellen said she has complete confidence in banking regulators and the American banking system is safe, amid the SVB crisis.

- Silicon Valley Bank is now the most significant failure since the 2008 financial crisis.

- DOW suffered the worst week since June.

- Silicon Valley Bank’s rapid collapse in 2 days created concerns in the banking industry.

- US Senator Menendez said they are not considering a bailout for the SVB.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -4.9%

S&P 500 = -5.1%

NASDAQ = -5.4%

RUSSELL 2000 = -7.8%

Gold = 0.7%

Silver = -2.9%

Oil = -4.9%

The weekly performance of S&P 500 Stocks

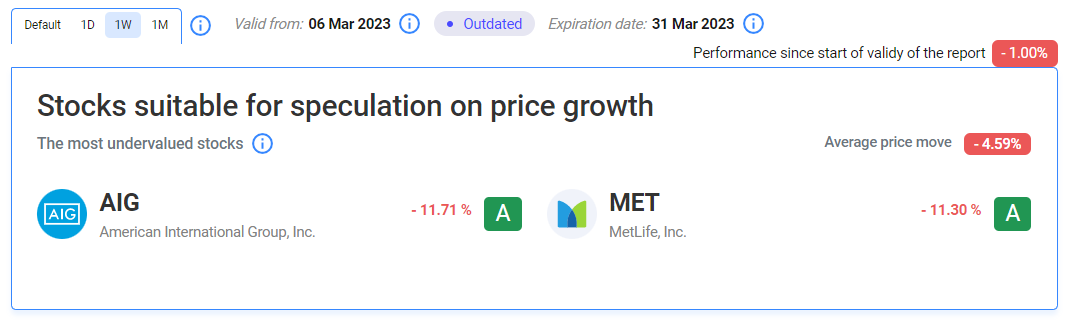

Our Two Least Performing Stocks:

The reason for both MET and AIG stock’s decline was SVB’s collapse since they both are insurance companies.

TIL: What is a bailout?

A bailout is when a business, an individual, or a government provides money and/or resources (also known as a capital injection) to a failing company. These actions help to prevent the consequences of that business’s potential downfall, which may include bankruptcy and default on its financial obligations.

Important data/ decisions that will be published next week:

The CPI and the PPI

The last week was really shocking for us as well. Despite many banking regulations, a vast bank rapidly collapsed again, which might lead to a more significant crisis.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.