Analysis of the Berkshire Hathaway Portfolio According to Markowitz’s Modern Portfolio Theory

Analysis of the Berkshire Hathaway Portfolio According to Markowitz’s Modern Portfolio Theory

Let’s imagine how would Harry Markowitz analyzed the portfolio of Warren Buffet. Analytical Platform took Warren Buffet’s portfolio* (Berkshire Hathaway) and analyzed it using the Modern portfolio theory developed by Harry Markowitz, which can be applied through the Portfolio Manager app.

These are the publicly-traded U.S. stocks owned by Warren Buffett’s holding company Berkshire Hathaway, as reported to the Securities and Exchange Commission in filings made available to the public.

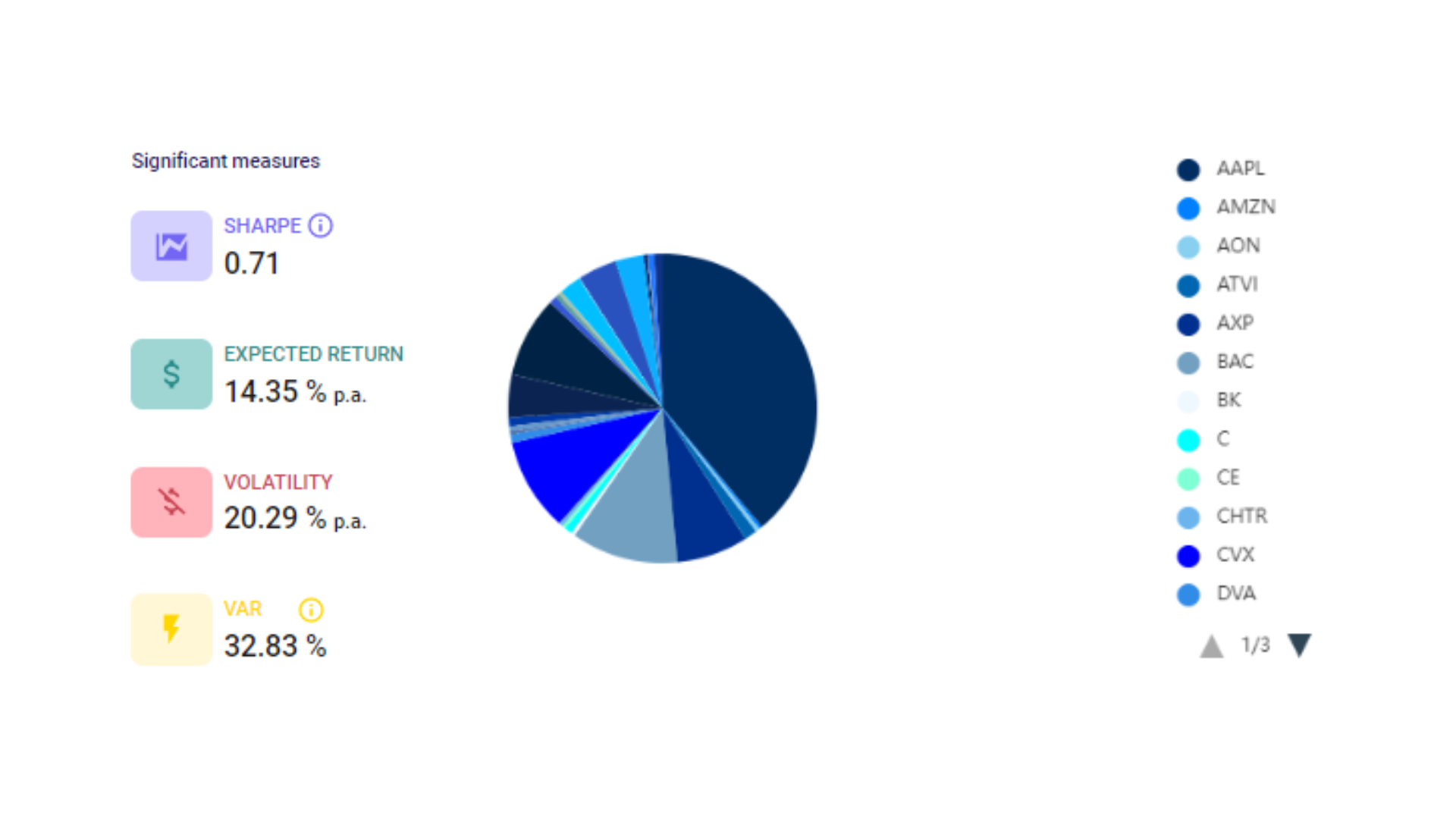

Results

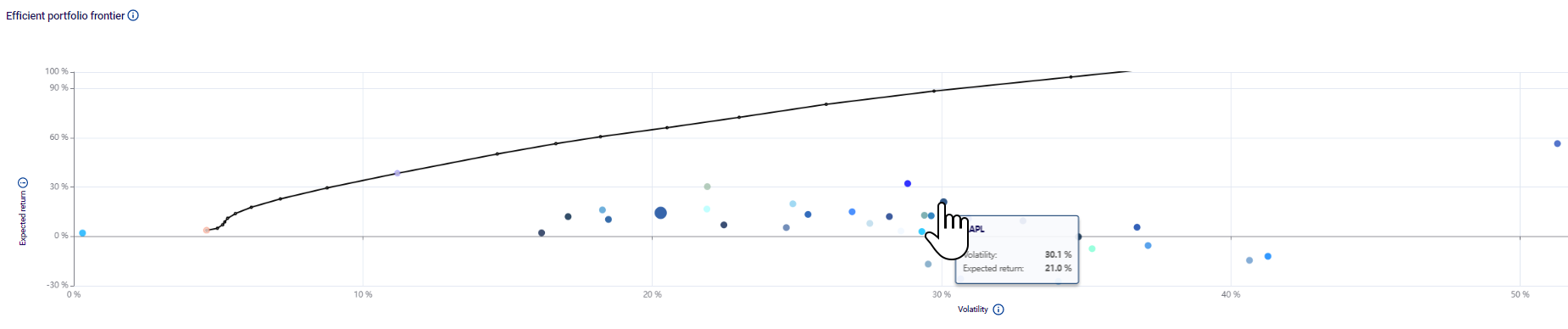

- The X-axis shows volatility, and the Y-axis shows the expected return, calculated based on price data since 2015.

- The largest blue dot represents the values of Buffet’s entire portfolio.

- The selected dot showcases the AAPL stock, which carries the highest weight in the portfolio.

- The efficient frontier consists of stocks from the S&P 500 index.

Sharpe Ratio Maximization

Markowitz’s theory provides the ability to optimize the portfolio by targeting objectives such as min. volatility, max. return, or max. Sharpe ratio. In this example, we aim to refine the Berkshire portfolio to attain the Max. Sharpe value, positioned on the curve of efficient portfolios (indicated by the purple dot).

What Is the Sharpe Ratio?

The Sharpe ratio compares the return of an investment with its risk. It’s a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk, rather than investing skill.

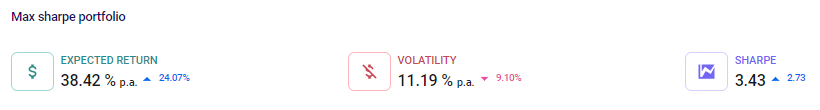

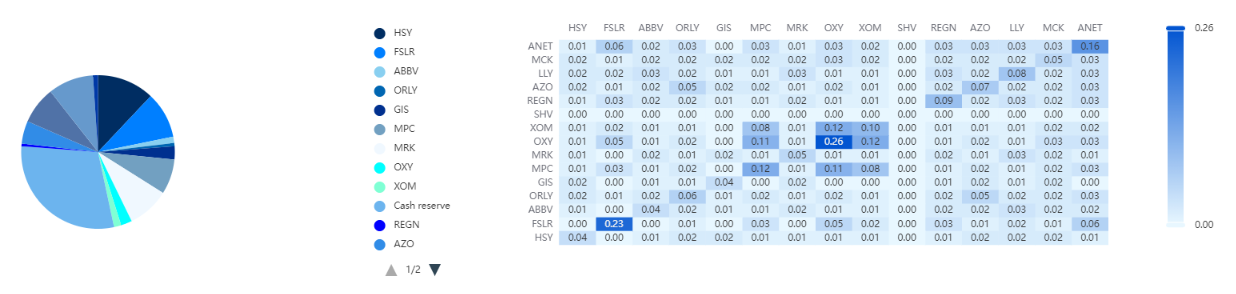

The max. Sharpe ratio portfolio

The max. Sharpe ratio portfolio would contain only 14 stocks, with weights ranging from 0.68% to 12.03%. If we consider the possibility of holding cash, it would play a significant role according to Markowitz’s theory, at 29.56%.

By implementing the Modern Portfolio Theory, one can potentially boost the expected annual return from 14.35% to 38.42%, decrease the annual volatility from 20.29% to 11.19%, and enhance the Sharpe ratio from 0.71 to 3.43 as part of the portfolio adjustment process.

Which approach is better? Buffet’s or Markowitz’s? ☺

We would be happy to analyze your own portfolio as well. For this purpose, we suggest using the Portfolio Manager application or other Analytical Platform tools.

Are you curious about the performance of your investment portfolio?

Wondering if there’s room for improvement? Look no further! The Portfolio Manager App is here to help, offering personalized analysis based on the same principles used to evaluate Warren Buffet’s renowned Berkshire Hathaway portfolio.

By utilizing the Portfolio Manager App, you can gain insights into your investments, just as we did with Berkshire Hathaway’s portfolio. Discover how to optimize your holdings according to objectives such as minimum volatility, maximum return, or maximum Sharpe ratio, empowering you to make more informed decisions about your investments.

Book Your Portfolio Optimization Meeting with Analytical Platform Now!

Here’s what you can expect from the Portfolio Manager (PM) App. It will:

- Evaluate your portfolio’s performance based on price data

- Assess the volatility and expected return of your investments

- Identify the optimal mix of stocks for your desired level of risk and return

- Strategically allocate assets to potentially increase your portfolio’s Sharpe ratio

Don’t miss out on this opportunity to elevate your investment strategy. Try it today and see the difference a well-informed approach can make! Harry Markowitz was awarded by Nobel Prize for this theory. Markowitz developed a theory, and we developed revolutionary software that enables its application.

Invest according to the Modern Portfolio Theory with revolutionary software

*Holdings are as of December 31, 2022, as reported in Berkshire Hathaway’s 13F filing on February 14. 2.92% of the Berkshire portfolio is missing from the pool as the assets are not available in the Analytical Platform.