Markowitz’s Modern Portfolio Theory: An Introduction

Markowitz’s Modern Portfolio Theory: An Introduction

What is Markowitz’s theory?

Markowitz’s theory, commonly known as modern portfolio theory (MPT), is a framework for developing and managing an optimal portfolio of financial assets. It is founded on the premise that investors should examine not only the predicted returns of each asset but also the risk and correlation between them.

Investors can decrease their exposure to unsystematic risk, which impacts single assets or groups of assets, by diversifying their portfolio across diverse asset classes, industries, locations, and strategies. Factors such as firm performance, industry trends, legislative changes, or natural calamities can all contribute to unsystematic risk. Investors can earn a higher return for a given level of systematic risk by minimizing unsystematic risk, which is the risk that impacts the entire market or economy. Inflation, interest rates, political instability, and global events can all contribute to systemic risk. Diversification cannot eliminate systematic risk, but it can be assessed and compensated for by better-expected returns.

Markowitz’s theory gives a mathematical method for determining the optimal portfolio, which maximizes expected return for a given level of risk or minimizes risk for a given level of return.

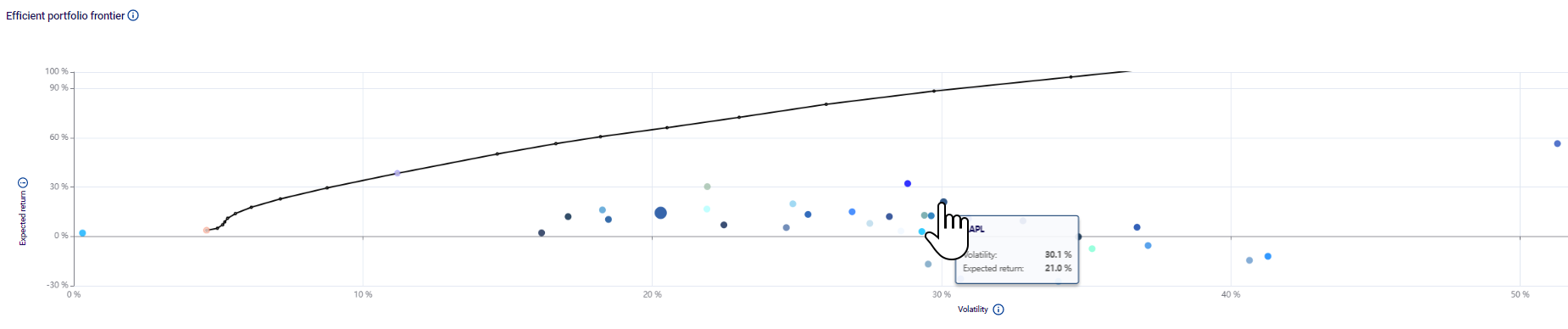

The efficient portfolio is the optimal portfolio, and it is located on the efficient frontier (which we also utilize in our platform), which is the curve that depicts the best potential return for any degree of risk. The efficient frontier is produced from an analysis that takes as inputs the expected return and standard deviation of each asset. The expected return is a weighted average of each asset’s possible outcomes based on historical performance, and the standard deviation is a measure of how far the actual return can deviate from the expected return.

According to Markowitz’s Modern Portfolio Theory, investors are rational and risk-averse, preferring bigger returns and smaller risks. It also presumes that investors have access to all necessary information about the assets and their future prospects, as well as the ability to exchange them without incurring any transaction charges or taxes. Under these assumptions, Markowitz’s theory implies that each investor has a unique optimal portfolio based on their risk tolerance and return expectations. This ideal portfolio is the point at which the efficient frontier intersects the investor’s maximum potential indifference curve. An indifference curve is a curve that depicts all risk and return combinations that provide the same amount of utility or satisfaction to the investor.

How did Markowitz’s theory develop?

Harry Markowitz, an American economist, came up with Markowitz’s theory. In the 1950s, he initially presented his hypothesis in a paper published in The Journal of Finance. He questioned the traditional method of investing analysis, which concentrated on individual stocks rather than portfolios, in this paper. He contended that investors should consider not just the predicted return and risk of each security but also how they are tied to one another. He suggested a mathematical methodology for determining the ideal portfolio for each investor based on utility.

Professionals mainly ignored Markowitz’s paper when he published his book in 1959. He expanded his idea in this book, providing more details and examples of how to use it. He also demonstrated some graphical tools to help illustrate his ideas.

Markowitz’s theory was further developed and refined by other researchers in subsequent years. Some notable contributions include:

- The Capital Asset Pricing Model (CAPM) was developed by William Sharpe and others in the 1960s. The CAPM is an extension of Markowitz’s theory that relates the expected return of an asset to its systematic risk or beta. The beta measures how sensitive an asset is to market movements. The CAPM implies that only systematic risk matters for determining asset prices and that all investors hold the same market portfolio.

- The Arbitrage Pricing Theory (APT) was developed by Stephen Ross and others in the 1970s. Arbitrage pricing theory (APT) is a multi-factor asset pricing model based on the idea that an asset’s returns can be predicted using the linear relationship between the asset’s expected return and a number of macroeconomic variables that capture systematic risk. It is a useful tool for analyzing portfolios from a value investing perspective in order to identify securities that may be temporarily mispriced [1].

What are the benefits and limitations of Markowitz’s theory?

Markowitz’s theory has several benefits and limitations for investors and portfolio managers. Some of the benefits are:

- It provides a rigorous and systematic framework for portfolio construction and evaluation based on sound economic principles and statistical methods.

- It emphasizes the importance of diversification and risk management and shows how to achieve them efficiently and effectively.

- It allows you to assess and compare the performance of various portfolios using measures like the Sharpe ratio. The Sharpe ratio and various other measurement methods are developed from Markowitz’s theory and describe the trade-off between risk and return.

- It lets investors adjust their portfolios to their tastes, goals, and restrictions by selecting the best degree of risk and return.

Some of the limitations are:

- It relies on historical data and estimates, which may not be accurate or representative of future conditions. The expected returns, standard deviations, and correlations of assets can change over time due to various factors, such as market cycles, structural shifts, or unexpected events.

- It makes unrealistic assumptions about investor behavior and market efficiency, which may not hold in reality. For example, investors may not be rational or risk-averse, they may have different information or beliefs, they may face transaction costs or taxes, or they may be subject to behavioral biases or emotions.

Conclusion

Markowitz’s theory is a significant contribution to financial economics and portfolio management. He introduced the ideas of diversification, the risk-return trade-off, efficient frontier, and optimum portfolio, which altered the way investors think about and approach investment. Academics, professionals, and regulators all across the world have embraced and used Markowitz’s theory. It has also sparked more study and development in portfolio theory and asset pricing models. Despite its flaws and problems, Markowitz’s theory remains relevant and important today.