Explanation of stock valuation

Explanation of stock valuation

In today’s article, we will follow up on the article New era of stock-picking and creation of investment strategies. At the end of the article, readers were asked for feedback regarding their understanding of our explanation of the factors relevant to stock ranking. Thanks for all the replies.

Let’s move on to “Explanation of stock valuation”.

We move further in the explanation and bring up-to-date ways in which we are able to explain our predictions, respectively the evaluation of specific stocks.

Below we present two approaches how to describe the ranking of the BMY, Bristol Myers Squibb Company, shared according to the model mentioned in the previous article.

Detailed variant A – stock valuation

This approach brings a technical explanation created for advanced users and analysts.

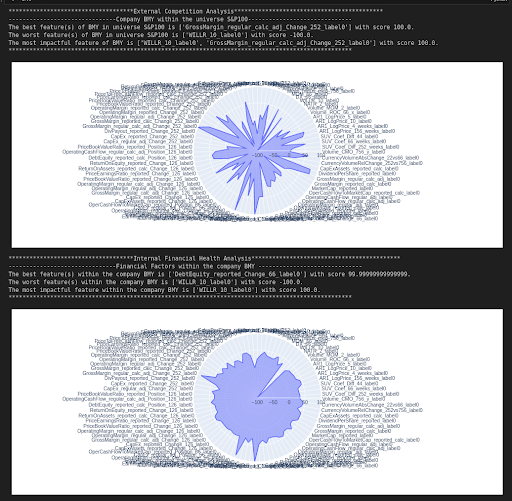

I. Company BMY within the Universe S&P100

1. Top Positive Feature in Universe: BMY stands out in the S&P100 universe for its change in Gross Margin (adjusted regularly and calculated) over the past 252 days, scoring a perfect 100. This places BMY as a top performer in this aspect, indicating robust gross profit margins relative to its peers.

2. Top Negative Feature in Universe: Conversely, BMY’s 10-day Williams %R (WILLR_10) is its weakest feature, scoring -100. This technical indicator’s negative score may reflect bearish momentum within this time frame, a concern for short-term investors.

3. Most Impactful Features in Universe: The change in Gross Margin and the WILLR_10 label stand as the most influential features for BMY within the S&P100 universe, illustrating the balance between fundamental profitability and short-term technical trends.

II. Financial Factors within the Company BMY

1. Top Positive Feature within BMY: Within the company’s financial structure, the change in Debt to Equity (D/E) ratio reported over the past 66 days ranks the highest with a score of nearly 100. This signifies a favorable debt management strategy and aligns with the company’s internal financial stability.

2. Top Negative Feature within BMY: The WILLR_10 label is identified as BMY’s most negative financial factor, with the lowest score of -100. This consistency across both dimensions underscores the potential short-term challenges that the company may face in market sentiment.

3. Most Impactful Feature within BMY: The WILLR_10 label is also recognized as the most impactful feature within BMY, reflecting its substantial influence on the company’s financial evaluation, particularly from a technical analysis perspective.

Conclusion

This analysis presents a nuanced view of Bristol Myers Squibb Company, encompassing both its position within the broader market and its internal financial characteristics. The insights drawn from the change in Gross Margin and Debt-to-equity ratio provide an optimistic outlook on the company’s profitability and financial stability. However, the negative score associated with the WILLR_10 label warrants attention, particularly for those focused on short-term trading dynamics.

Investors, stakeholders, and decision-makers should consider this multifaceted analysis to understand BMY’s complex financial landscape. By recognizing the strengths in Gross Margin and Debt Management and monitoring the short-term indicator WILLR_10, they can craft more informed strategies tailored to both long-term growth and immediate market response. This synthesis offers an integrated perspective on BMY, considering its competitive positioning and inherent financial attributes. It should serve as a foundational analysis for various stakeholders in the investment and management process.

Simplified variant B – stock valuation

This approach brings a simplified view following testing with people who only have a basic understanding of stock investing.

Part 1: How BMY Compares to Other Big Companies (S&P100)

- Best Part: BMY’s profit margin over the past year is the best in the bunch. It means they’re keeping a lot of the money they make!

- Needs Improvement: A measure called WILLR_10, which helps guess short-term stock movements, shows that BMY could do better compared to others. This might worry those who invest for just a few days or weeks.

- Biggest Influences: Both the profit margin and WILLR_10 have the most significant effect on BMY’s stock. They balance how well the company is doing with what’s happening right now in the stock market.

Part 2: What’s Happening Inside BMY

- Best Part: BMY has been smart with how they use debt recently. This shows they’re handling their money well!

- Needs Improvement: That same WILLR_10 measure isn’t looking so hot for BMY itself. It might mean the stock could have some short-term challenges.

- Biggest Influence: Again, WILLR_10 has the most substantial effect inside BMY. It’s something the company might want to look at more closely.

So, What’s All This Mean?

- BMY’s making a healthy profit, and they’re being smart with their money. That’s great news!

- But, there’s a little warning sign called WILLR_10 that could mean some short-term ups and downs in the stock. If you’re thinking about investing, you might want to keep an eye on this.

- Overall, BMY seems to be doing well, but every company has things they can work on. The good news is they’ve got a lot going for them.

Call to action

We hope this article helped you gain a better perspective on stock valuation. We will be happy for your feedback on the mentioned ways of explaining. It will greatly help us to improve the quality of our information service.

In return, we offer access to our apps in their Beta version, before their official release.

Jiří Fuchs, CEO a co-founder of Analytical Platform