The AP on the Street 18th week of 2023

The AP on the Street 18th week of 2023

The last week, we mainly had negative results. Only NASDAQ, Gold, and Silver had positive results last week.

We have the CPI and Core CPI, the PPI and Core PPI. So, let’s take a look at what happened last week:

- Reserve Bank of Australia increased the interest rates by 25 basis points —making it 3.85%. The markets were not expecting a hike or cut.

- Morgan Stanley is planning a layoff for around 3,000 employees.

- IBM put a “hiring” freeze, with the intention of replacing them with Artificial Intelligence.

- Chegg shares sunk around 50% in one day after its CEO admitted that ChatGPT is a threat.

- US JOLTs fell to 9.5 million —0.2 million less than expected.

- PacWest shares tumbled around 25% amid the regional banking crisis.

- Invesco Regional Bank index plunged around 5% to its lowest level since October 2020.

- UBER shares jumped 10% after better-than-expected financial reports.

- Treasury Secretary Janet Yellen warned that the treasury would run out of cash as soon as June 1st unless Congress could not agree on the Debt Ceiling deal.

- Lawmakers are urging Chairman Powell to halt rate hikes, despite the rates still being negative in real terms compared to the Core CPI.

- POTUS Biden said that in the event of a debt default, the rates would rise, and mortgage rates would skyrocket.

- Euro Zone CPI rose 7.0% year on year, as expected.

- Euro Zone Core CPI rose 5.6% year on year —10 basis points better than expected.

- Carl Icahn lost over $10 billion on the Hindenburg report.

- Kremlin said that it was attacked by two drones, claiming that it was a planned terrorist attack.

- Federal Reserve increased the interest rates by 25 basis points, as expected —making it 5.25%. The highest level since January 2021.

- Federal Reserve signaled a pause in the June FOMC meeting, saying that it will depend on data from now on.

- FED Chairman Powell said that the banking conditions broadly improved since early March, stating that the US Banking system is sound and resilient.

- FED Chairman Powell said that inflation pressures are still continuing, and they are firmly committed to bringing inflation back to 2%.

- FED Chairman Powell said that they would not consider rate cuts if the inflation stays high.

- PacWest shares plunged even more.

- Western Alliance shares tumbled around 25%.

- PacWest confirms strategic talks after the shares plunged.

- US Treasury is considering De Facto deposit insurance on all accounts to prevent a regional banking crisis.

- First Horizon National Bank shares plunged after TD Bank called off its acquisition deal.

- European Central Bank increased the interest rates by 25 basis points, as expected —making it 3.75%. The highest since October 2008.

- Western Alliance becomes the latest bank that is looking for a potential sale; shares sunk around 50%.

- PacWest shares sunk even more after consecutive days of loss.

- US Unemployment Rate fell to 3.4% —20 basis points lower than expected, 10 basis points lower than the previous number.

- PacWest shares soared around 70% after a regional bank rally.

- Apple shares rose around 5% after better-than-expected earnings and a $90 billion buyback plan.

- Warren Buffett said that the US cannot print money indefinitely. However, he stated that he sees no option other than the dollar as a reserve currency.

- Warren Buffett says Berkshire Hathaway is not planning to buy Occidental Petroleum.

- Berkshire Hathaway shareholders rejected climate and diversity proposals, keeping Buffett as chairman.

- Warren Buffett said that Berkshire Hathaway is cautious about US Banks since the sector could face more turbulence ahead.

- Secretary Yellen said that a failure of Congress to act would cause an economic catastrophe.

- ISM Manufacturing PMI came out as 47.1 points —0.3 points better than expected.

- Services PMI came out as 53.6 —0.1 points worse than expected.

- ISM Non-Manufacturing PMI came out as 51.9 —0.1 points better than expected.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -1.3%

S&P 500 = -0.8%

NASDAQ = 0.2%

RUSSELL 2000 = -0.8%

Gold = 1.2%

Silver = 2.1%

Oil = -5.77%

The weekly performance of S&P 500 Stocks

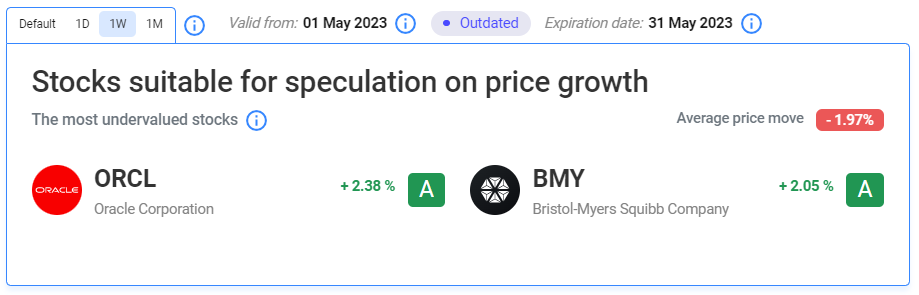

Let’s look at the most undervalued stocks listed on our website:

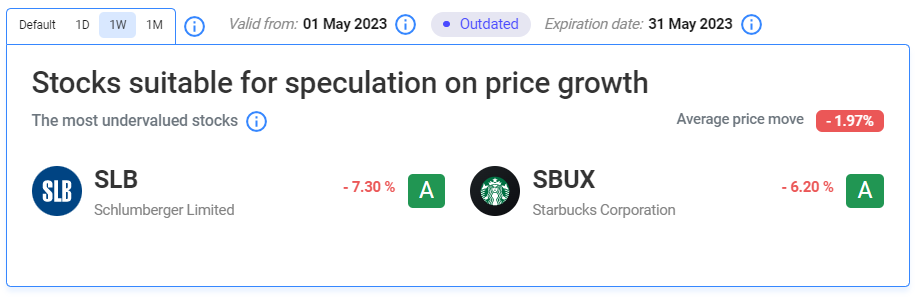

Our Two Least Performing Stocks:

The main reason(s) for the decline in SLB:

SLB missed on Q1 earnings and reported a weaker-than-expected cash flow.

The main reason(s) for the decline in SBUX:

Despite announcing a better-than-expected report, we suppose its price crashed due to market behavior.

TIL: What is Arbitrage?

Purchasing an asset from one market and selling it to another market where the selling price is higher than what you paid for it resulting in a profit.

Important data/ decisions that will be published next week:

The CPI and Core CPI, the PPI and Core PPI.

We will see how the investors will behave after all of the data and decisions. Stay tuned.