Active investors utilize investment software to outperform passive products, such as ETFs. But to succeed, three key elements must come together.

1) Building a winning investment strategy

First, a reasonable strategy must be designed to meet the investor’s investment goals. The creation of such a strategy is a core feature of the Analytical Platform app. It is important to keep track of all the fees that are part of our strategy, like transaction fees, spreads, and the cost of borrowing money for leveraging. Moreover, a general goal is to minimize the need for portfolio rebalancing, which can be achieved using an indicator such as portfolio turnover.

2) Straightforward taxation of gains

With an active approach to investing, investors typically exceed the limits for investment income tax exemptions and do not meet the time test for securities holding. Therefore, it is important to be able to easily obtain tax returns from your brokerage statements at a reasonable price. At Analytical Platform, we are well aware of this, which is why we also provide our users with a free tax application. Besides, the good news is that the range of tax applications in the market for different countries and brokers is expanding.

3) Easy portfolio adjustments

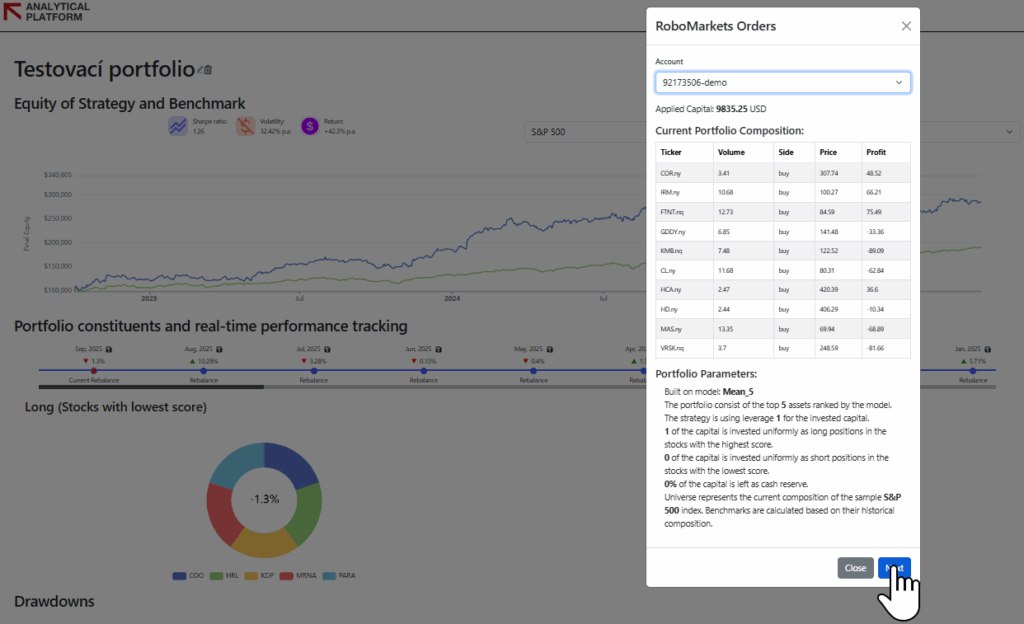

Data-driven strategies typically require more frequent adjustments — sometimes dozens per month. That is time-consuming and error-prone. To reduce this burden, we focus on the automation of rebalancing and integration directly with brokers. Instead of spending hours with manual adjustments, we can rebalance the portfolio within seconds or take advantage of fully automated portfolio management.

We have recently integrated the European broker RoboMarkets. Their trade cost is about 0.5 % of the trade value. There are no fixed purchase fees. This cost structure allows users to run strategies even with moderate capital. In our Indicator Investing app, after creating a strategy, users can simply click on the RoboMarkets button and adjust their portfolio with this German broker in just three clicks.

Try semi-automated rebalancing

Anyone can try out this feature as part of a free one-month trial. The process is simple:

- Add the RM token in the user profile section of the Analytical Platform. After entering the token, your brokerage accounts will be imported automatically.

- In the strategy interface, click the RoboMarkets button, then select which account you want to apply the strategy to.

For guidance on locating your token or advanced working with the RoboMarkets API, you can check the Fintree article.

September 30, 2025, Jiří Fuchs, CCFR/Analytical Platform

Register today & enjoy one month

FREE trial of our application