AI powered investment management beating the S&P 500

AI powered investment management beating the S&P 500

At Analytical Platform, we are well aware of the benefits that AI powered investment can bring. For the past 3 years we have been successfully trading our AI strategies on Interactive Brokers. In that timeframe our investment portfolio based on picking the best stocks from S&P 100 has gained 76.8 %, with staggering 18.4% annual returns. Comparatively S&P 500 during the same interval went up only 46.2 %, which means it earned about 66% less money.

With the ability to process vast amounts of data and identify trends that humans might miss, AI systems are quickly becoming a powerful tool in the world of investing. I shared a bit more on the topic in a previous article describing Stock Analysis with The Power of AI.

However as with any tool, there are risks involved. Without proper oversight, AI might lead to algorithmic bias and other issues that can harm investors. In this article, I will explore the importance of human oversight in AI powered investment and how to mitigate risks.

Investment management

Overall, investment management requires a solid understanding of finance, statistics, technology, and data management. If you decide to do your own analysis, please, please do it properly. Set a schedule, where you review and rebalance your portfolio so you catch possible problems on time. No analysis is valid forever. Find a time to setup a constant surveilling and monitoring of your investments. Unexpected events happens and you can lose a lot of money because you were preoccupied elsewhere. Setup a news feed regarding your investment, so you won’t miss an important information.

Investment management is not a “set and forget” solution.

Factor investing

When constructing portfolio, we rely on multi-factor asset pricing models based on the idea that an asset’s returns can be predicted using relationship between the asset’s expected return and a number of micro and macro economic variables (factors) that capture systematic risk. It is a useful tool to identify securities that may be temporarily mispriced, before the market eventually corrects and securities move back to their fair value.

Portfolio construction

Portfolio construction in multi-factor analysis involves combining the factor’s scores and weights to determine capital allocation across individual securities. Depending on your investment strategy and requirements, here are some key considerations for portfolio construction:

Weighting scheme

The choice of weighting scheme depends on your investment objectives, risk appetite, and beliefs about the efficiency of factors. Some common weighting schemes include:

- Equal weighting: Such approach assumes that each factor contributes equally to the portfolio’s performance.

- Risk-based weighting: Considering the factor volatility or covariance matrix, allocating more weight to securities with lower risk contributions can improve risk profile.

- Optimization: Using mathematical techniques can help with an optimal balance between factors and diversification. Overall goal is to maximize portfolio’s expected returns while considering factor exposures, risk constraints, and any other specific requirements.

Constraints and considerations

Undoubtedly, any additional constraints or considerations should also be incorporated in the portfolio construction process, e.g.:

- Position limits: Limits on the maximum and minimum allocation to individual securities to manage risk concentration or maintain desired exposures.

- Sector neutrality: Ensure the portfolio is sector-neutral or has controlled sector exposures to avoid unintended biases.

- Transaction costs: Account for transaction costs associated with buying or selling securities, which can impact portfolio performance.

- Liquidity considerations: Take into account the liquidity of securities when constructing the portfolio to ensure practical execution of trades.

Rebalancing

Regularly monitor the performance of the multi-factor portfolio and adjust the weights as needed to maintain desired factor exposures or adapt to changes in market conditions. Rebalancing can be done on a fixed time interval or triggered by specific events or thresholds.

Risk management

Consider risk management techniques to control the overall risk of the portfolio. This may involve setting risk limits, incorporating risk models, or implementing stop-loss mechanisms to mitigate downside risk.

Backtesting and simulation

Extensive backtesting and simulation of the constructed portfolio needs to be performed in any case. Evaluate the historical performance of the portfolio using relevant metrics, analyze factor exposures and their contribution to returns, and assess risk characteristics. This helps gauge the effectiveness of the multi-factor portfolio construction methodology.

AI Investment management

One of the key advantages of AI is the ability to automate many of the tedious tasks mentioned above. AI systems can do factor analysis, factors loading, scoring, take into account considerations and limits, rebalance portfolios and many more.

This saves investors time and allows them to focus on other aspects of their lives while still ensuring that their investments are being managed effectively.

All of these benefits are being applied in a growing number of AI powered investment funds in order to focus on performance side rather than on management side of the fund. These funds, such as our own fund, are then able to provide better performance, while still keeping management cost down.

Oversight of AI powered investment

Implementing appropriate governance is crucial to reduce risks associated with AI powered investing. This can be done by leveraging machine learning explainability, which is one of the key tools for implementing oversight in AI systems. In general, it is the ability to understand how an AI system arrived at a particular decision. By understanding how an AI system makes decisions, analysts can identify potential biases and take steps to correct them.

How to make sure AI is working correctly

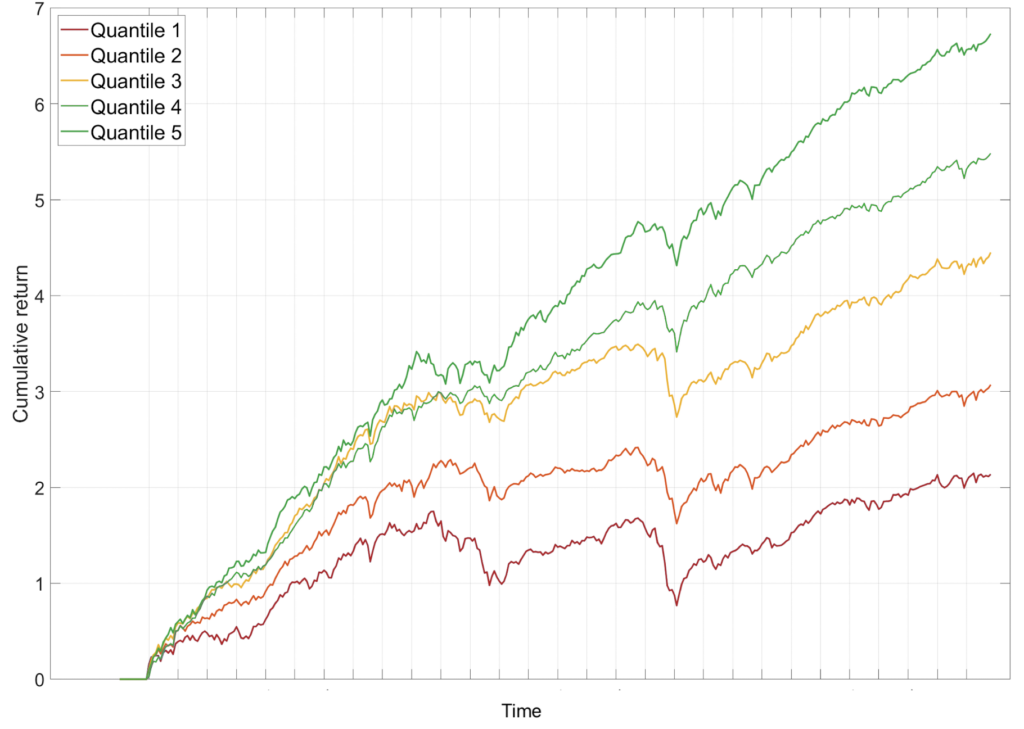

One of the great tools that we are using, is part of our backtesting. Based on the multi-factor analysis, our model determines those assets that outperforms the market and those that underperform. Consequently we split them into groups and simulate their investment on historic market data. Basically we “roll back time” and then perform walk forward test on various time intervals.

We look for situation, where the top group has gained highest returns and conversely the bottom group has lowest returns.

That means our model is able to successfully identify assets that outperform the market as well as assets which underperform!

These tests are of course performed regularly to make sure our model is still working correctly.

Vladimir Vacula